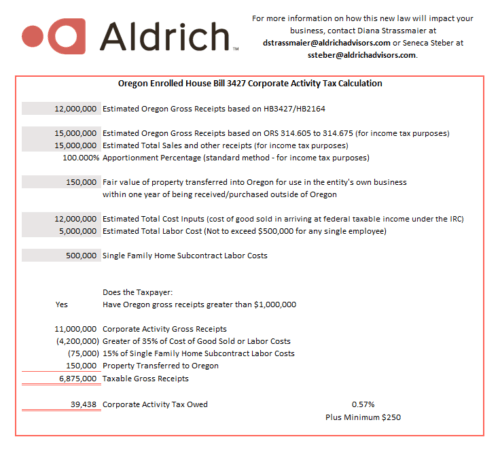

Oregon Cat Tax Worksheet

Oregon Cat Tax Worksheet - Cat Meme Stock Pictures and Photos

The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax;

Oregon cat tax worksheet. Grocery & tv mart has $10 million of oregon commercial activity and $70 million of everywhere. As discussed earlier, the tax is not owed if the person's taxable commercial. Wait until ohio cat tax worksheet is ready to use.

Oregon's cat is measured on a business's commercial activity —the total amount a business realizes from transactions and activity in the normal course of business in oregon. What is a “substantial nexus”? 1, 2020, regardless of a taxpayer's year end for accounting and federal income tax purposes.

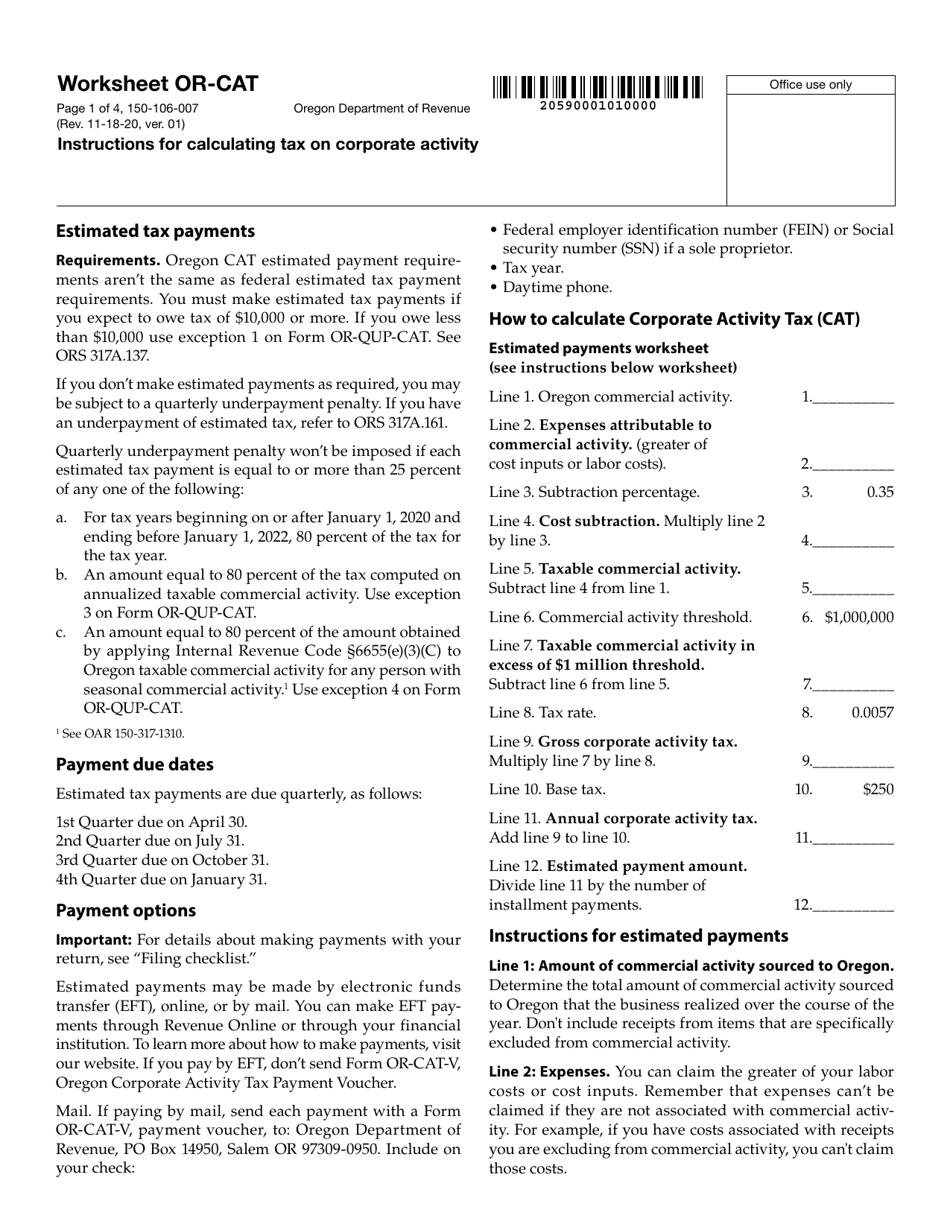

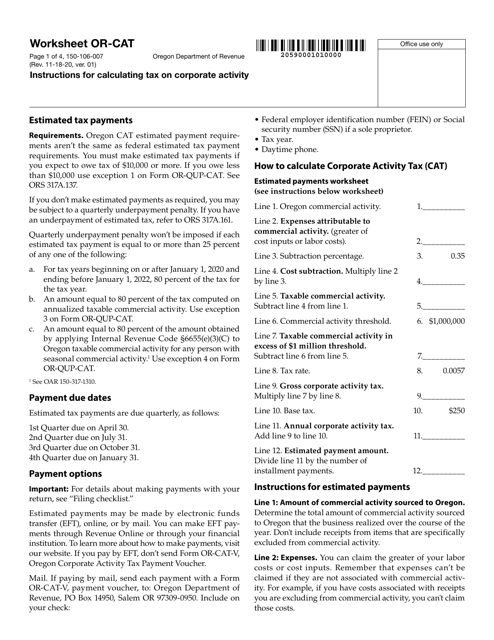

Taxable commercial activity generally equals oregon source gross receipts, less a deduction for 35% of the greater of labor costs, or the cost of inputs. Read the following instructions to use cocodoc to start editing and drawing up your ohio cat tax worksheet: Printable oregon state tax forms for the 2021 tax year will be based on income earned between january 1, 2021 through december 31, 2021.

For more information about the tax, see the or dor. Oregon has enacted a new gross receipts tax on any commercial entity with gross receipts in excess of $1 million from oregon specific sources and is expected to raise $1 billion per year for oregon schools. A taxpayer may be subject to both oregon income tax and cat.

Top 10 elk hunting outfitters top 50 hardware store chains. Buffalo leather laptop bag 10 top high fiber foods cast iron griddle top top 10 beaches in maine. It is 0.57% of a firm’s oregon taxable commercial activity in excess of $1,000,000 plus $250.

Don’t enter zero on lines 12 or 13 unless you have computed exception 3, line 12 (use worksheet on page 2) or exception 4. The cat is effective for tax years beginning on or after jan. The corporate activity tax, referred to as the oregon cat, was enacted on may 16, 2019, with h.b.