Oregon Cat Tax Percentage

Oregon Cat Tax Percentage - Cat Meme Stock Pictures and Photos

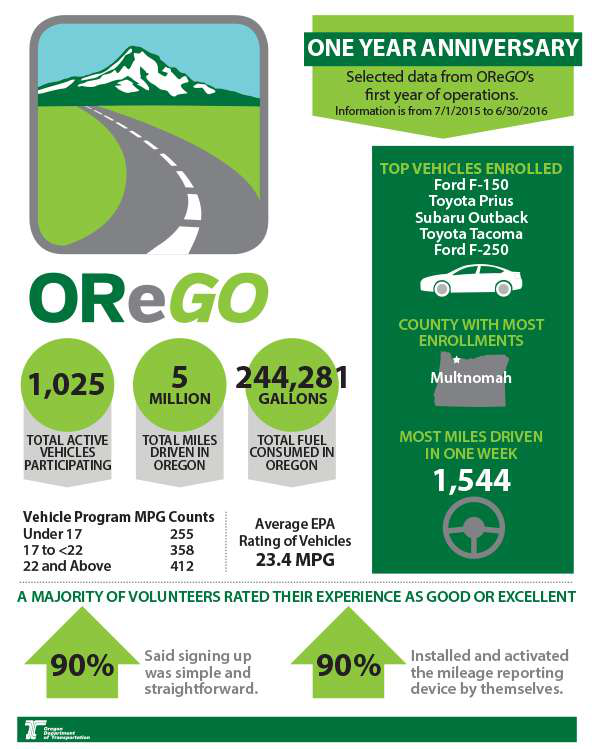

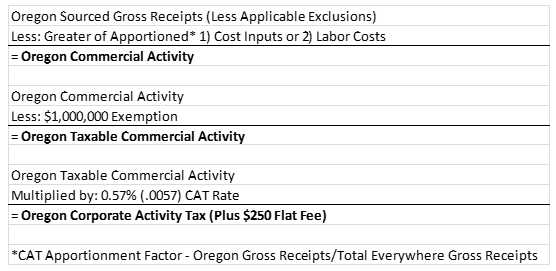

8 taxpayers whose taxable commercial activity does not exceed $1 million are exempt from the oregon.

Oregon cat tax percentage. Information contained in this presentation is current as of oct 20, 2020. On may 16, 2019, oregon governor kate brown signed into law house bill 3427, which established an annual corporate activity tax (cat) based on commercial activity conducted by businesses, effective for tax years beginning on or after jan. A person is defined to include not only corporations, but also individuals, partnerships, limited.

The new corporate activity tax (cat) will be imposed on “taxable commercial activity” in excess of $1 million at a rate of 0.57%, plus a flat tax of $250. Grocery & tv mart has $10 million of oregon commercial activity and $70 million of everywhere. •common ownership of more than 50 percent.

•tax on business entities’ commercial activity in oregon. The new business tax aims to raise $1 billion a year for schools. On march 27, 2020, oar and nearly fifty other industry groups sent a letter to governor brown asking her to suspend oregon’s new corporate activity tax (cat).

The tax is computed as $250 plus 0.57 percent of oregon commercial activity in excess of. The new rules went into effect on february 1, 2020. The new law is quite complex and arguably not very well thought out by lawmakers.

It is 0.57% of a firm’s oregon taxable commercial activity in excess of $1,000,000 plus $250. However, taxpayers (including unitary groups) exceeding $750,000 of oregon “commercial activity” are required to register for the cat within 30 days of meeting. The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax;

The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million. The oregon department of revenue (the “department”) recently issued four new temporary rules relative to the oregon corporate activity tax (the “cat”). The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million.

/s3.amazonaws.com/arc-wordpress-client-uploads/wweek/wp-content/uploads/2020/03/26101245/Screen-Shot-2020-03-26-at-10.10.38-AM.png)