Oregon Cat Tax Form

Oregon Cat Tax Form - Cat Meme Stock Pictures and Photos

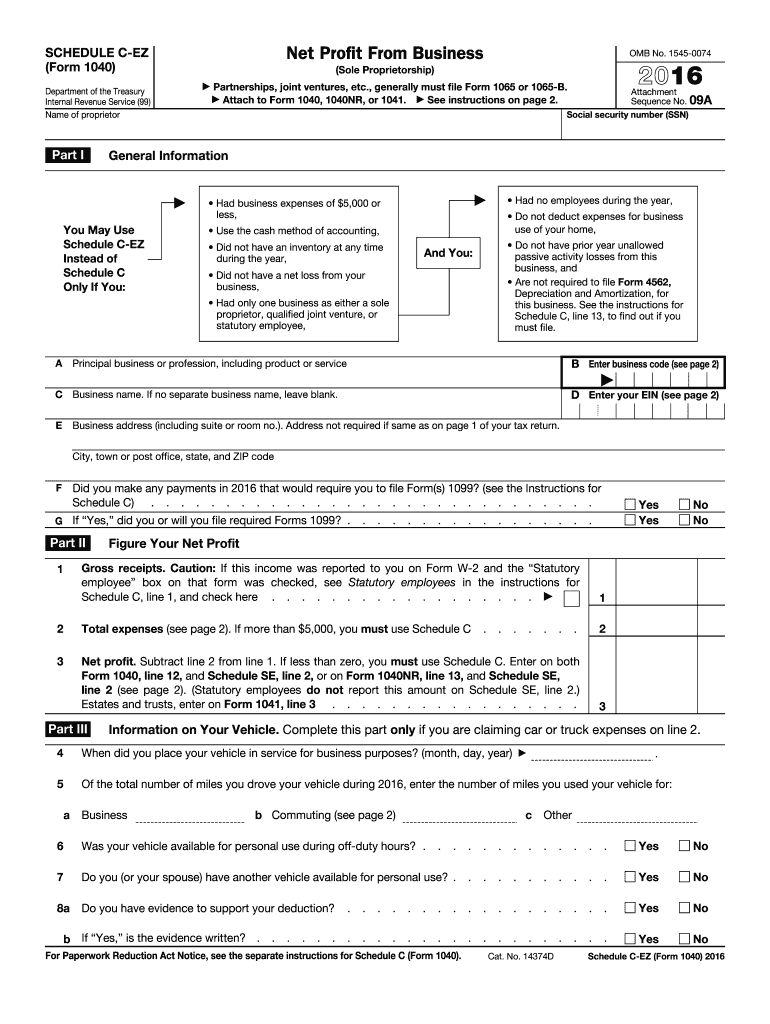

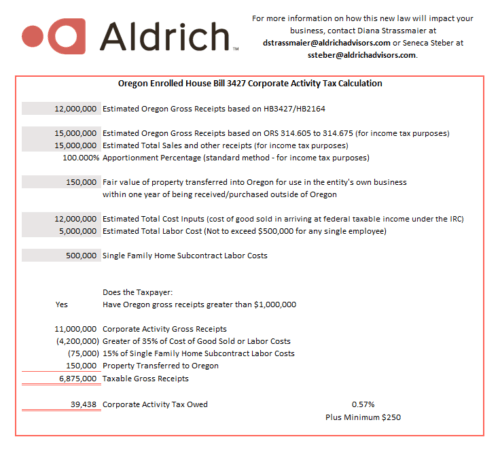

The oregon cat allows for a routine deduction of some costs of doing business, resulting in a downward adjustment of the tax base.

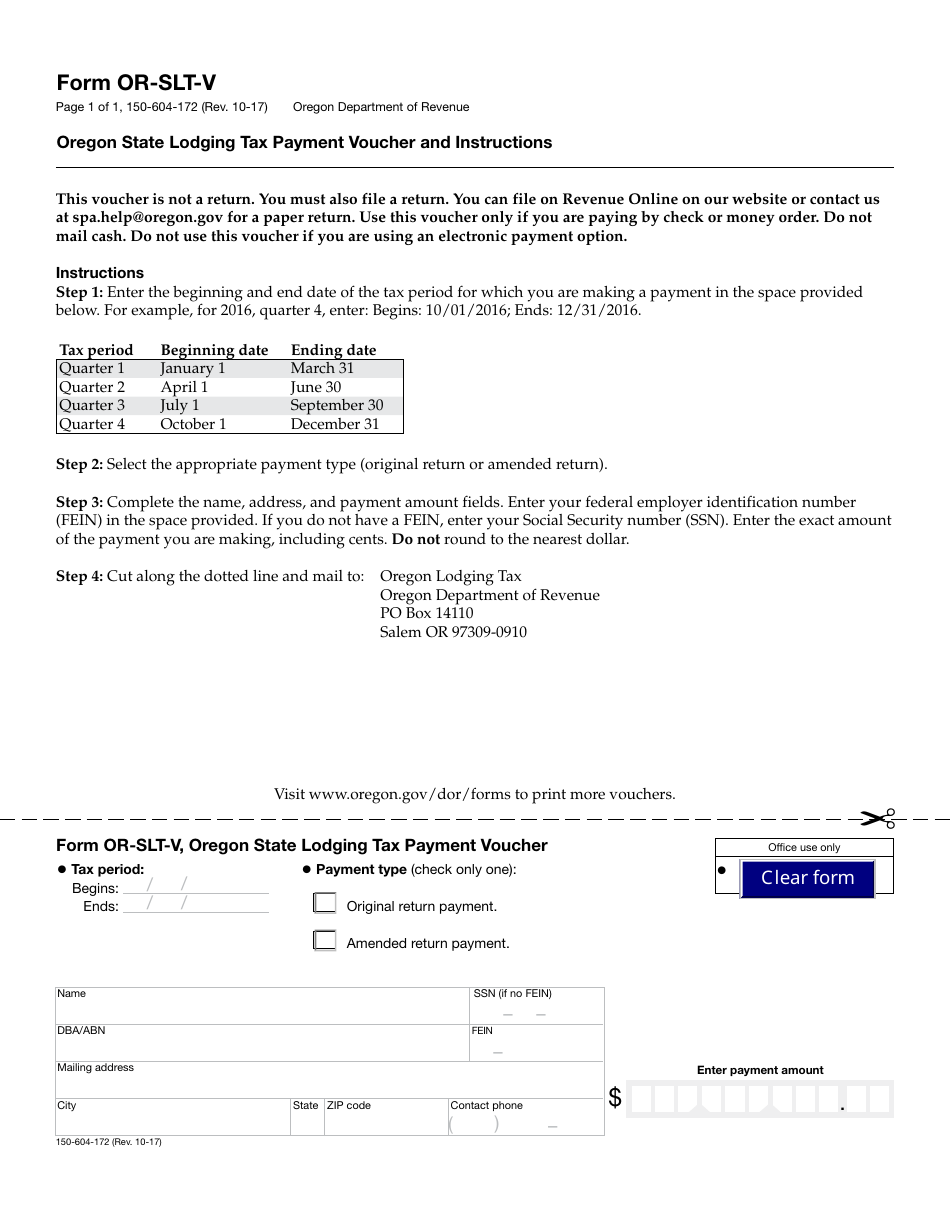

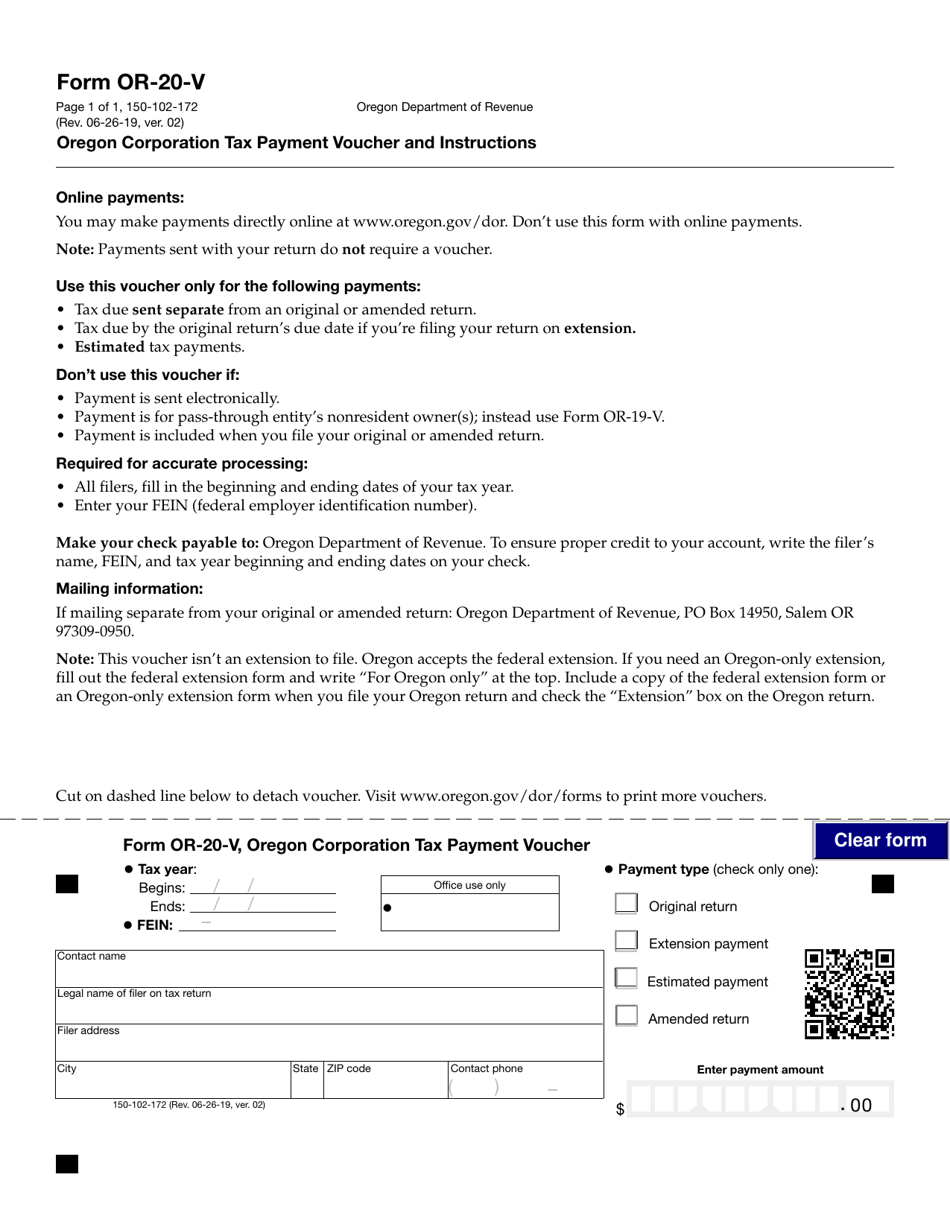

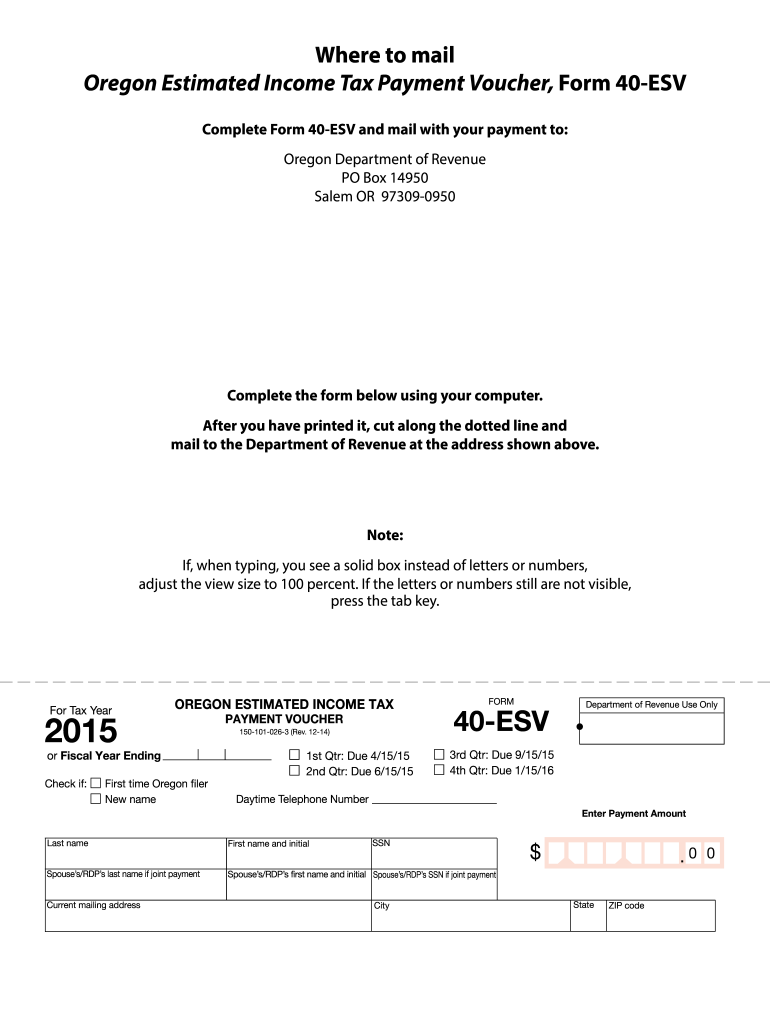

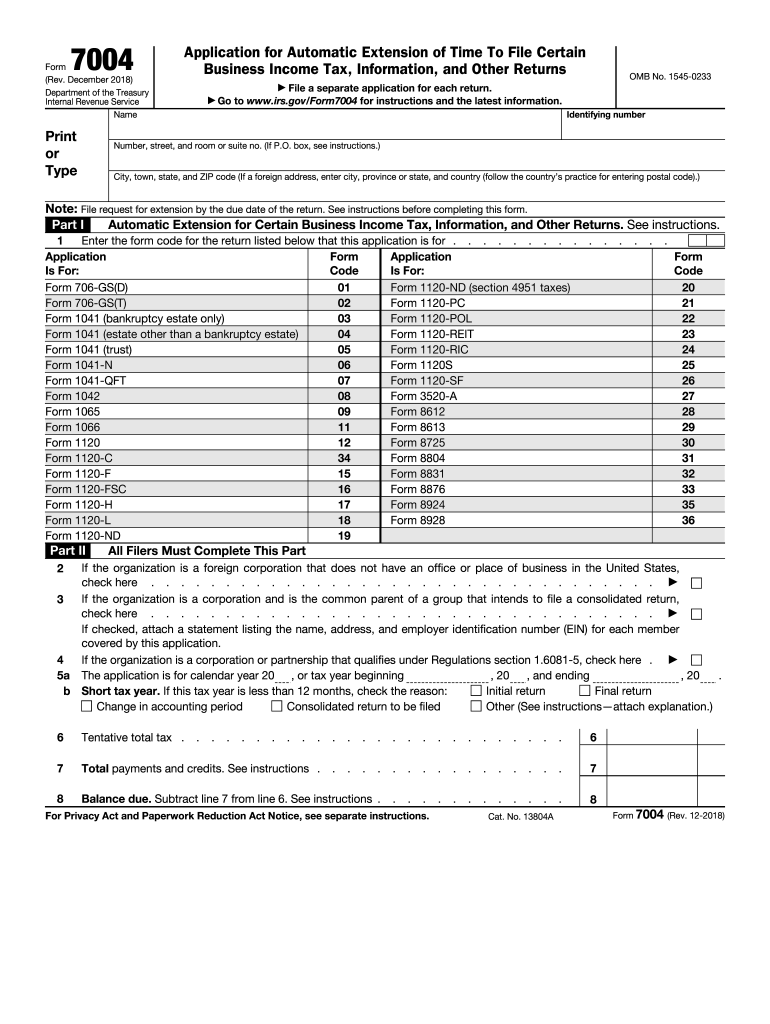

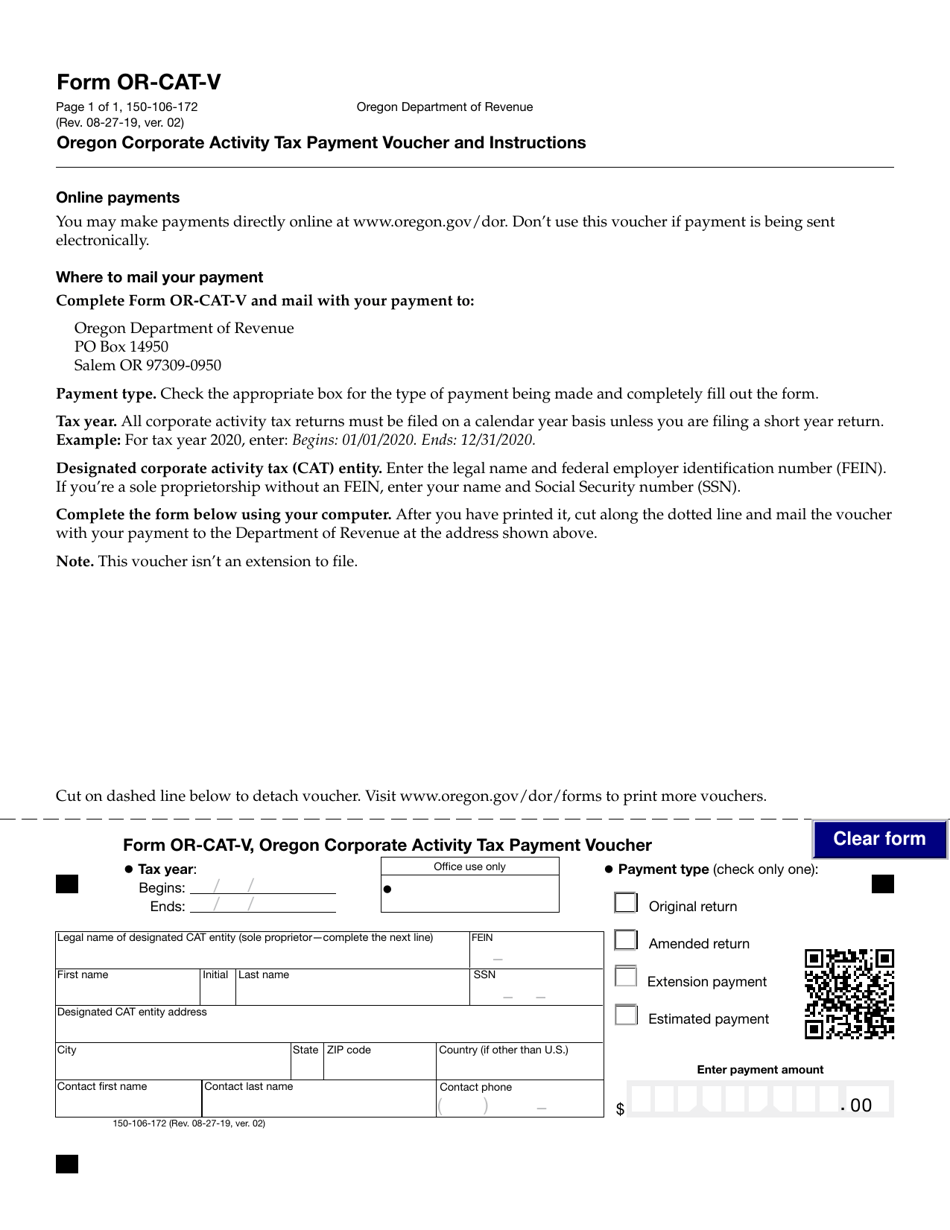

Oregon cat tax form. If you have more items than will fit on a single schedule, provide the codes and amounts on Payments made with extension or other prepayments for this tax year. Due to the hurried nature of developing a brand new tax regime, the cat was destined for future revisions.

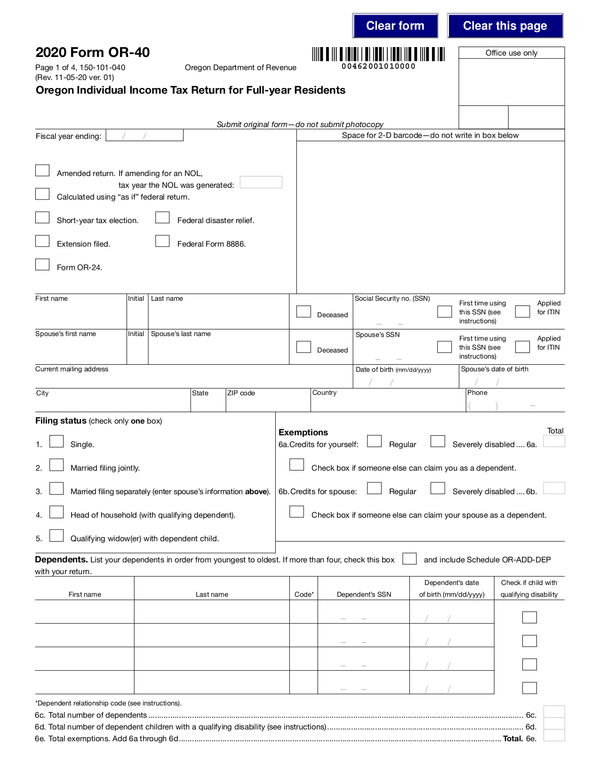

The oregon income tax rate for tax year 2021 is progressive from a low of 4.75% to a high of 9.9%. You must be registered for oregon corporate activity tax (cat) prior to submitting this form. 23/01/2020 · where is the form for oregon corporate activity (cat) tax?

The state income tax table can be found inside the oregon form 40 instructions booklet. Legal name of entity 6. 7 votes vote now if this is a.

01) • use uppercase letters. Oregon senate bill 164, which was recently signed into law, modifies certain provisions of the corporate activity tax (cat). • use blue or black ink.

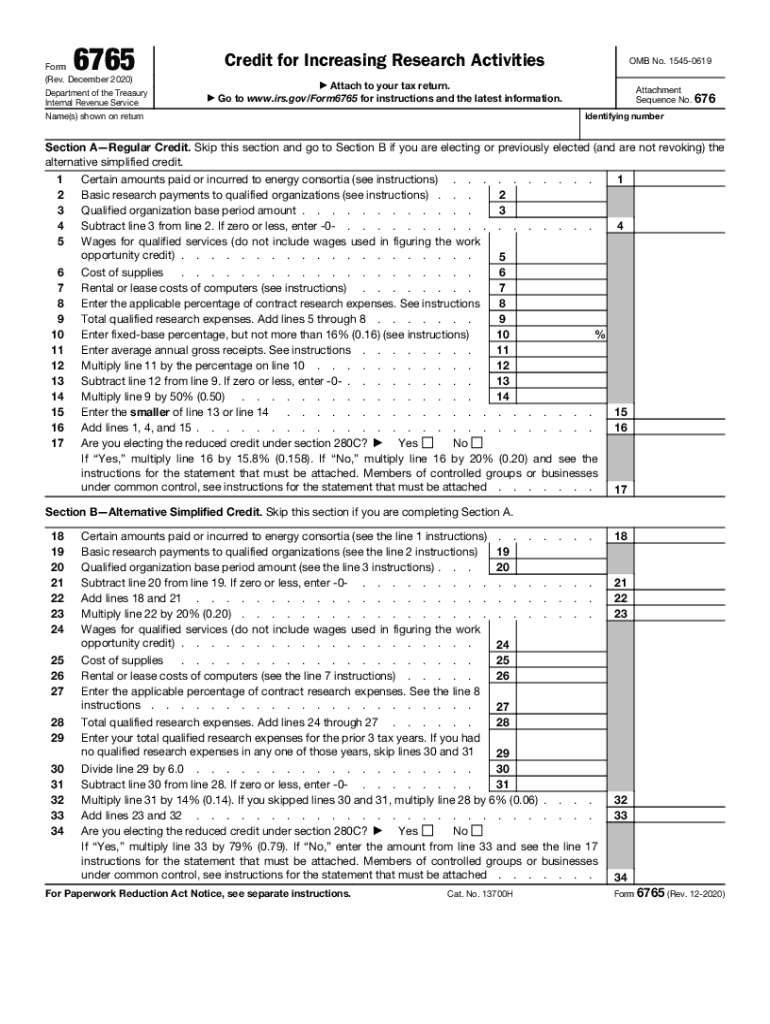

Use codes from the appendices from the 2021 instructions. The cat tax equals $250 plus the product of the taxpayer’s taxable commercial activity in excess of $1 million for the calendar year multiplied by.57%. Sb 164 provides that for a fiscal tax year ending during 2021, taxpayers will be required to file short.

• use blue or black ink. A taxpayer may be subject to both oregon income tax and cat. The cat is a modified gross receipts tax imposed on all types of business entities doing business in this state.