Oregon Cat Tax Form Instructions

Oregon Cat Tax Form Instructions - Cat Meme Stock Pictures and Photos

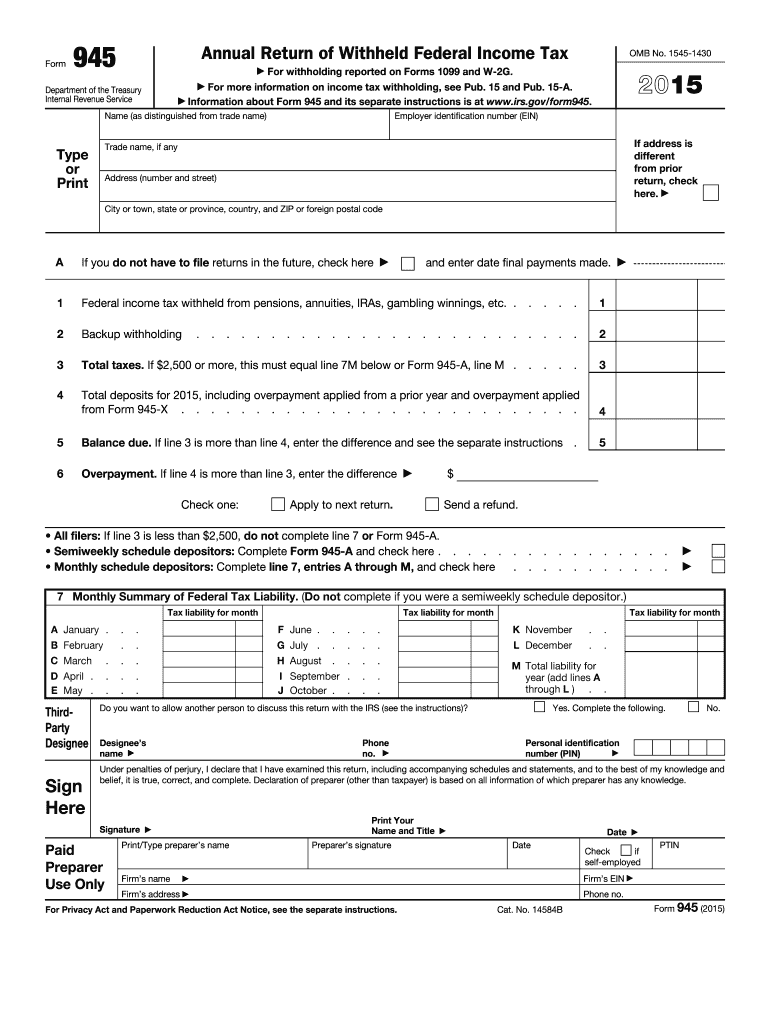

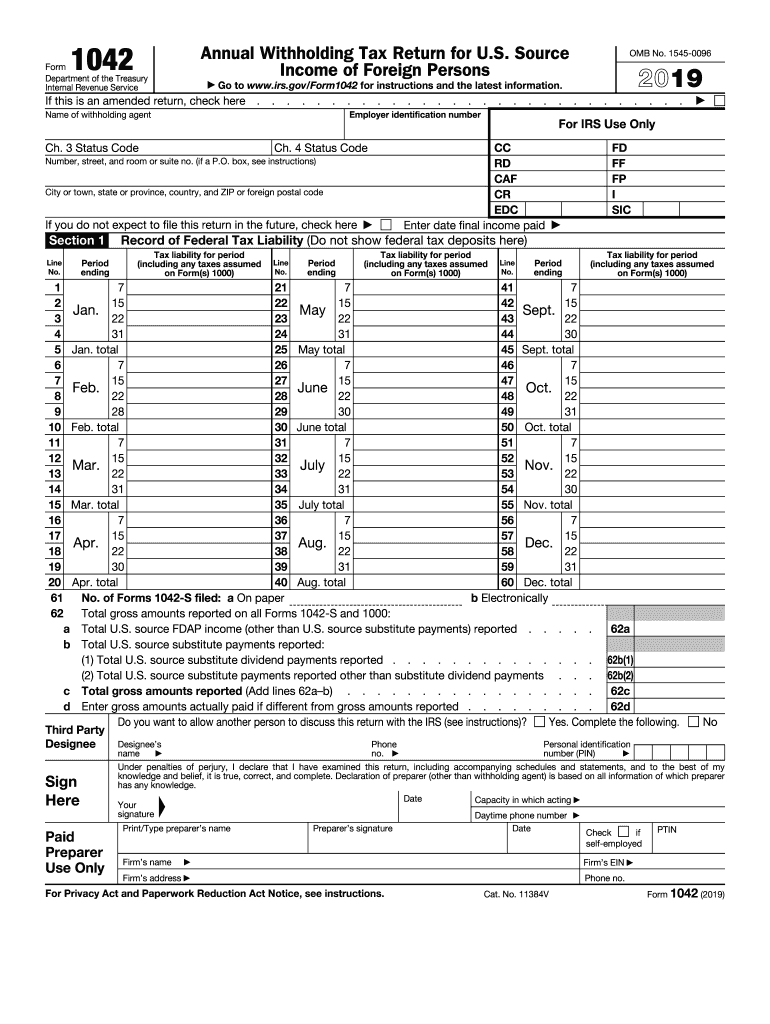

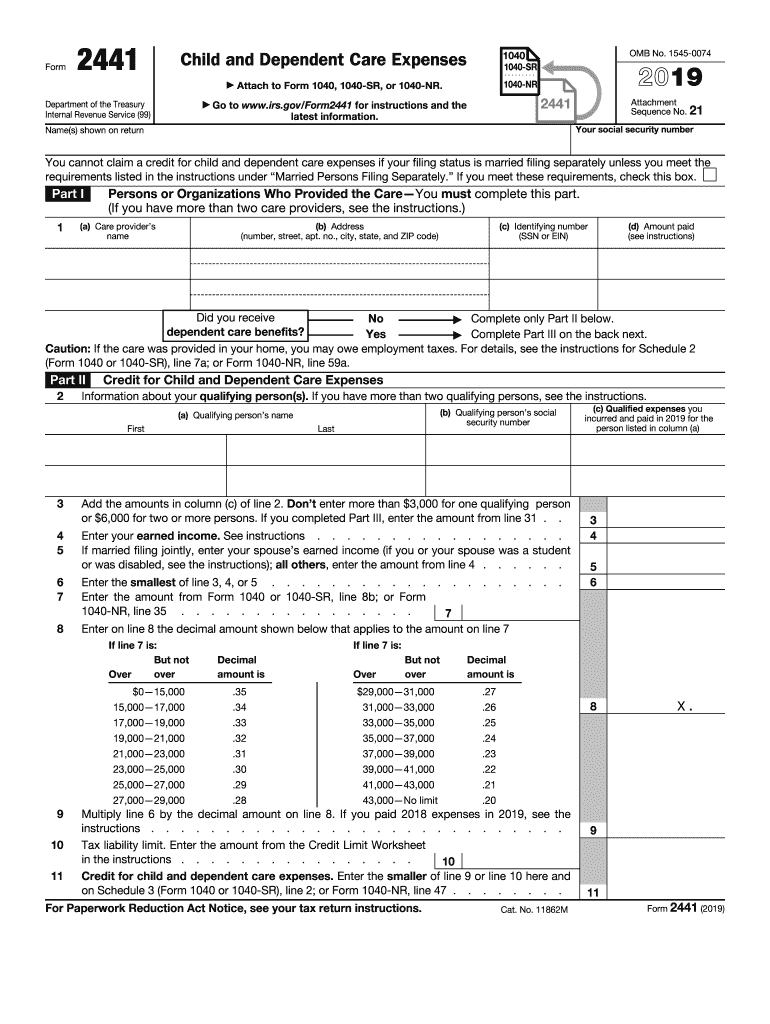

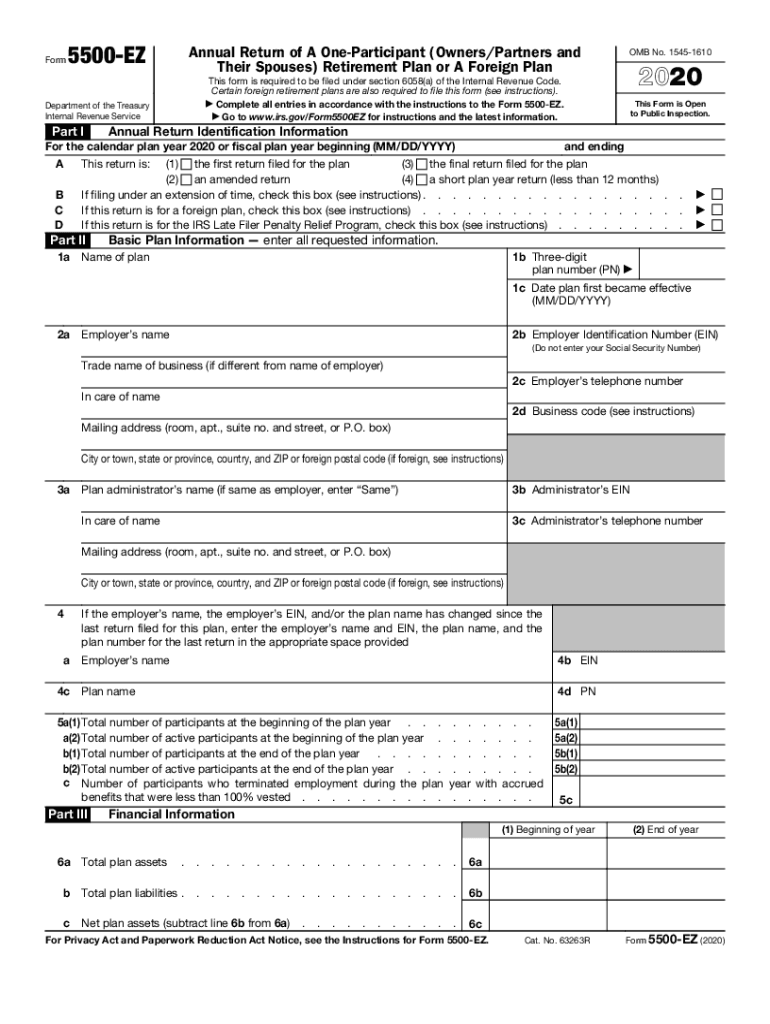

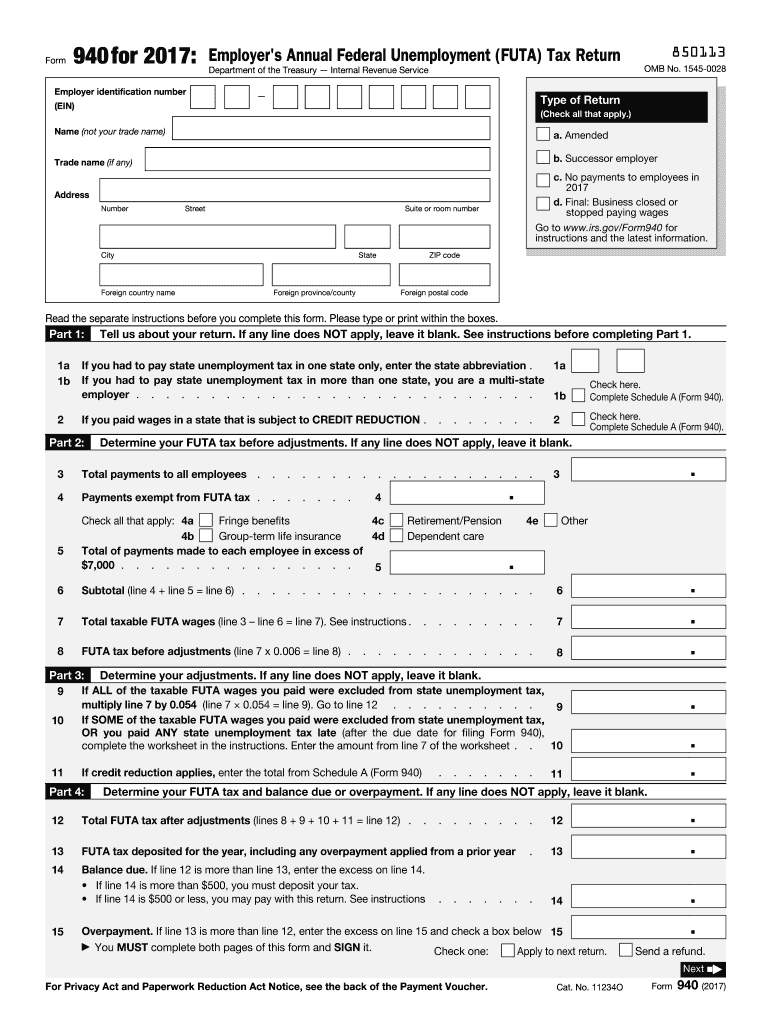

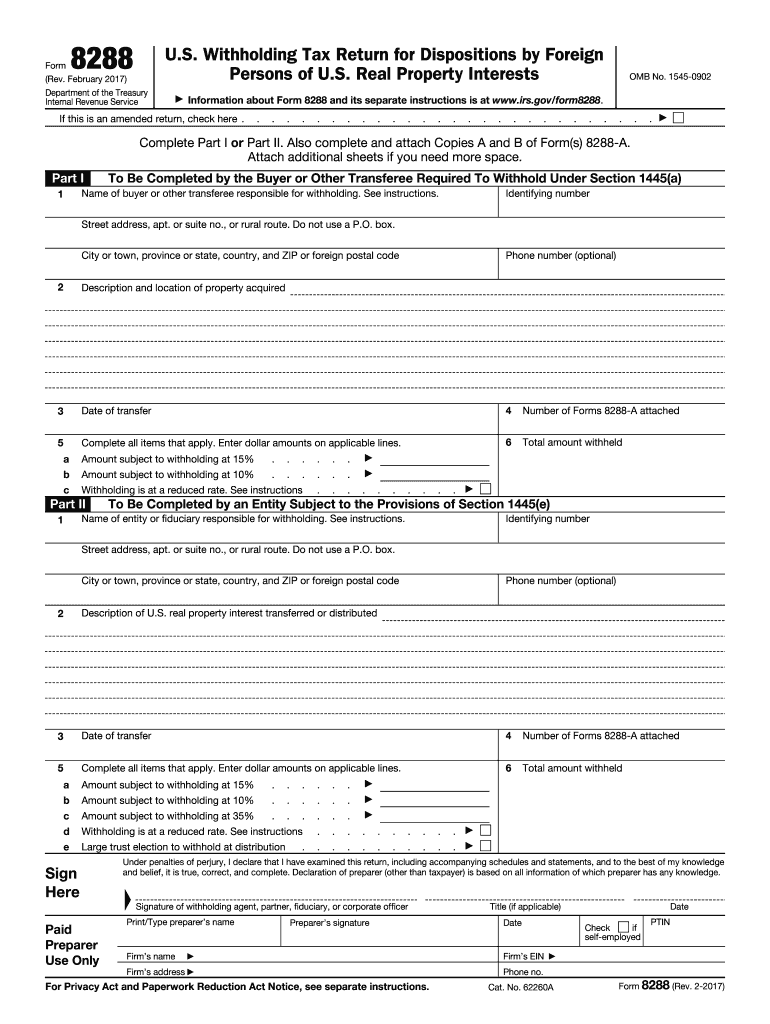

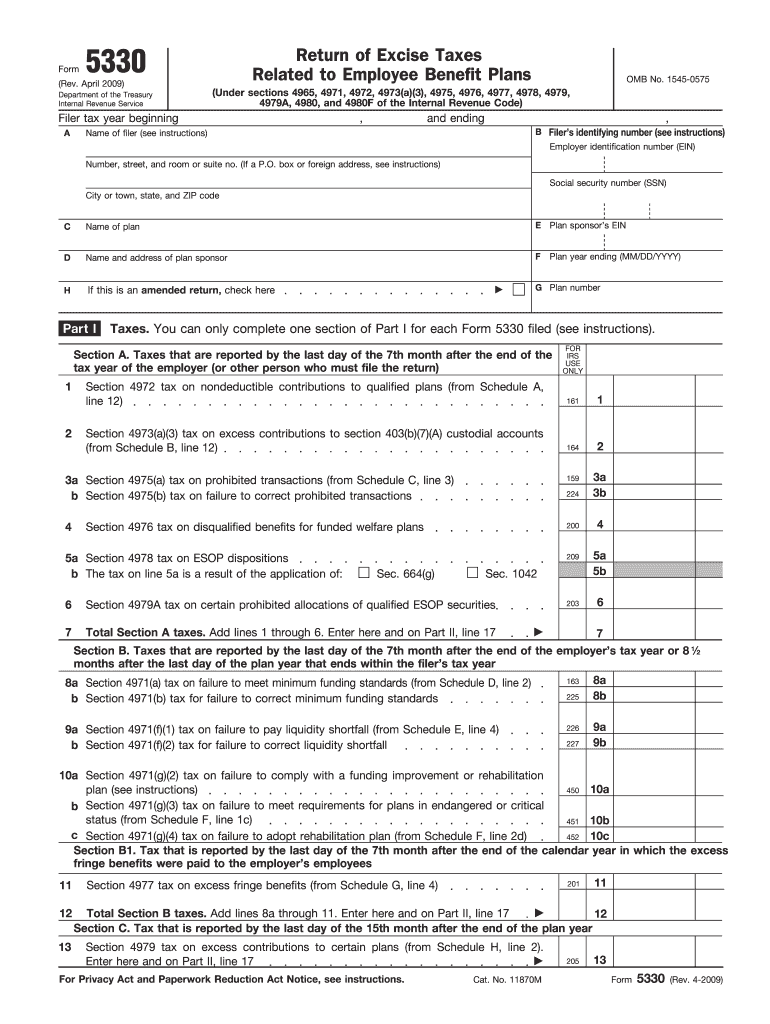

Enter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below.

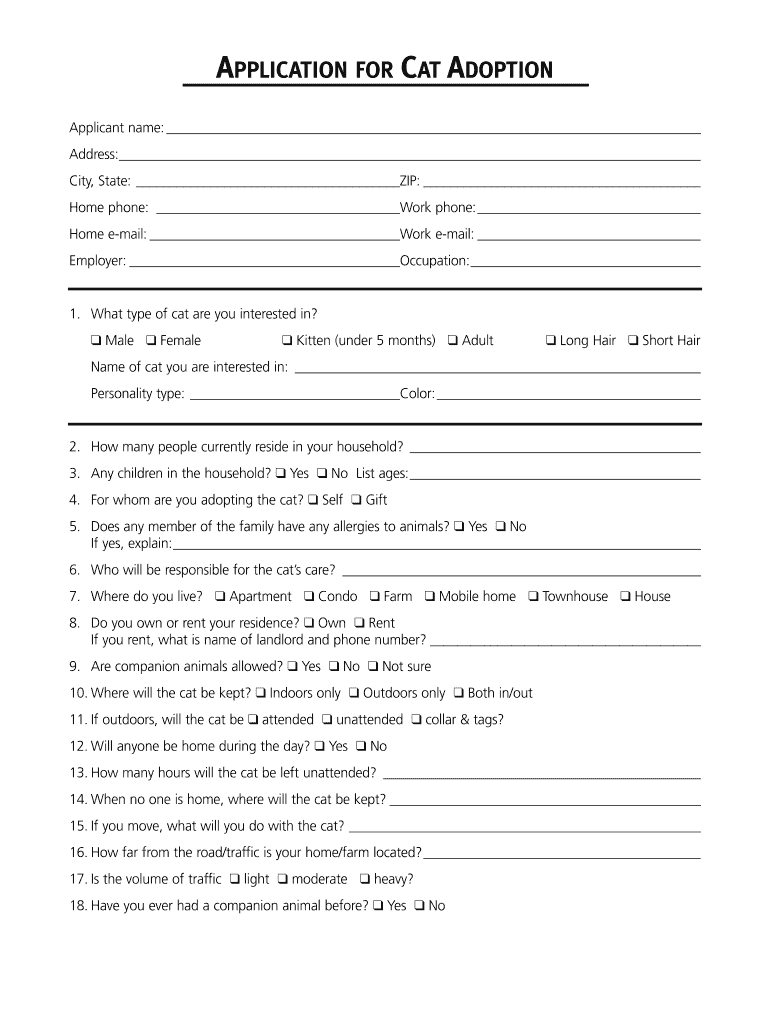

Oregon cat tax form instructions. • cat returns will be due on the 15th day of the fourth month following the end of the taxpayer’s tax year. Eep it with your tax records. This is the amount you expect to enter on 1.

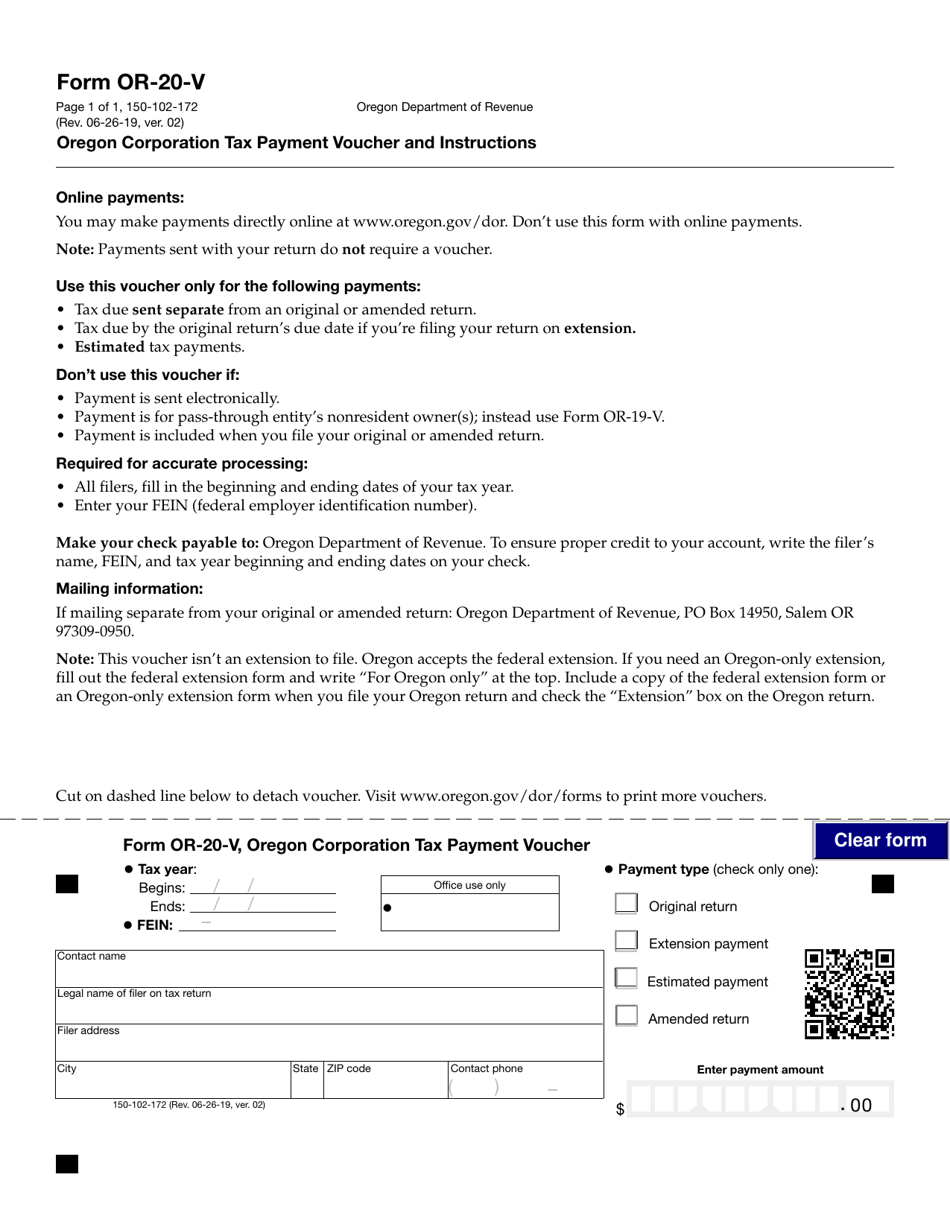

Secure access to tools for managing your oregon tax account. The oregon income tax rate for tax year 2021 is progressive from a low of 4.75% to a high of 9.9%. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax due.

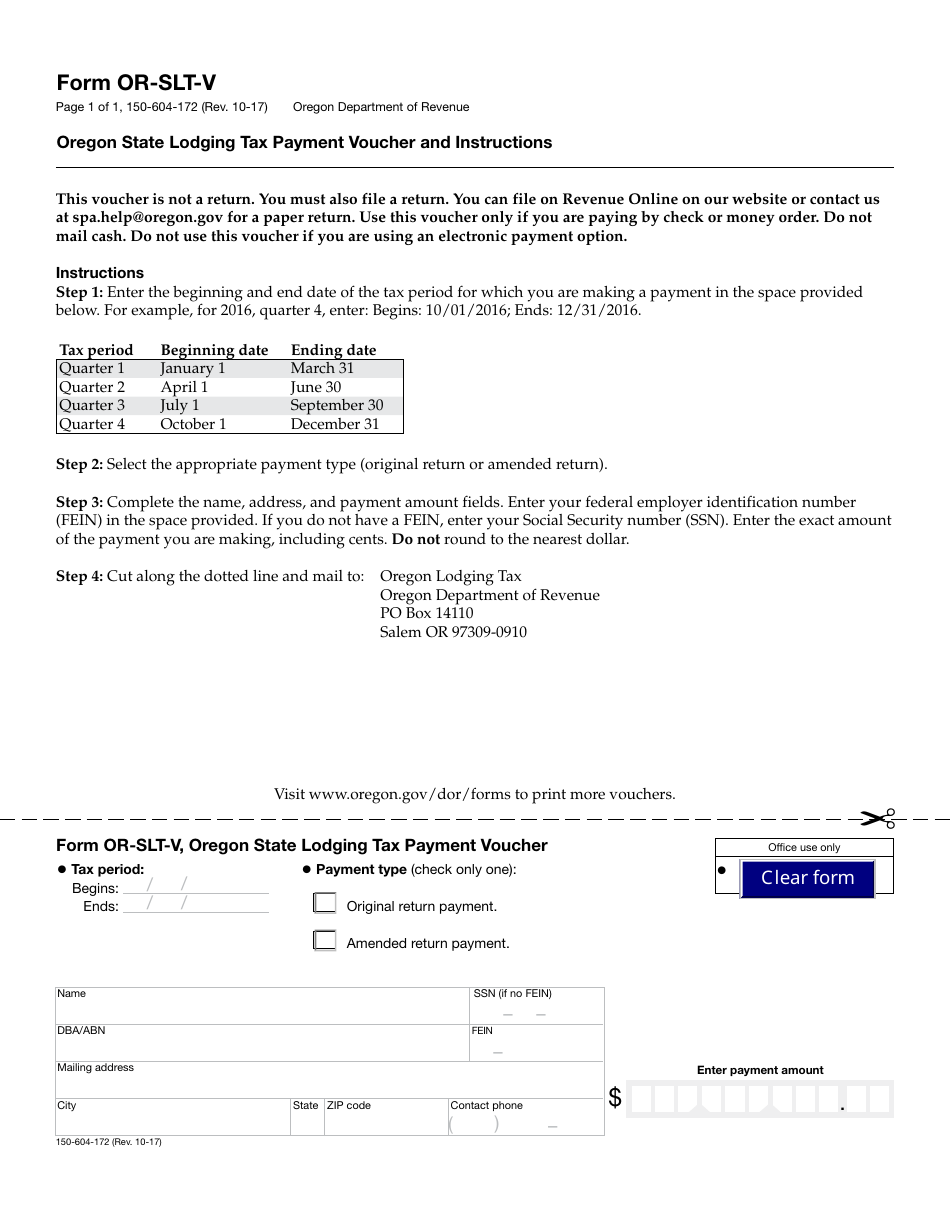

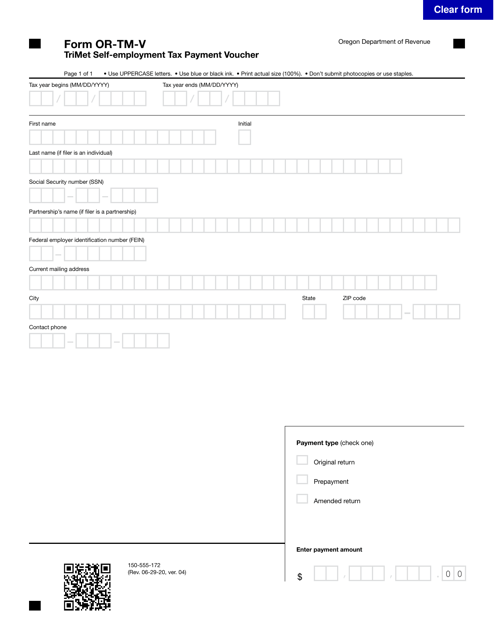

• print actual size (100%). Fillable online 2020 form or cat instructions oregon corporate activity tax 150 106 003 1 fax email print pdffiller. Register for the corporate activity tax.

The basics of the tax. • don’t submit photocopies or use staples. The cat is applied to taxable oregon commercial activity in excess of $1 million.

This form is for income earned in tax year 2021, with tax returns due in april 2022. 23/01/2020 · where is the form for oregon corporate activity (cat) tax? Last and first name of the taxpayer :

Explore oregon city downtown historic preservation municipal elevator neighborhoods ocwebmaps facts parks and trails directory photo/video gallery visitor information willamette falls legacy project willamette falls webcam; Printable oregon state tax forms for the 2021 tax year will be based on income earned between january 1, 2021 through december 31, 2021. Or cat forms for sch f are needed as well.