Oregon Cat Tax Exclusions

Oregon Cat Tax Exclusions - Cat Meme Stock Pictures and Photos

Last week, the oregon department of revenue (“dor”) issued three draft rules regarding the oregon commercial activity tax (“cat”).

Oregon cat tax exclusions. The tax is computed based on a calendar year beginning jan. As we announced in our most recent post on this topic, the oregon department of revenue (the “department”) will soon commence the rule drafting process. Oregon governor kate brown signed hb 4202 into law on june 30, 2020.

Some revenue/receipts are excludable from cat. 16 at a high level, the cat’s sourcing rules follow oregon’s apportionment regime for its corporate excise (income)17 tax: Groceries to narrow exclusions designed to prevent the cat from being imposed on other taxes or fees collected by the taxpayer.15 to be subject to the cat, commercial activity must be sourced to oregon.

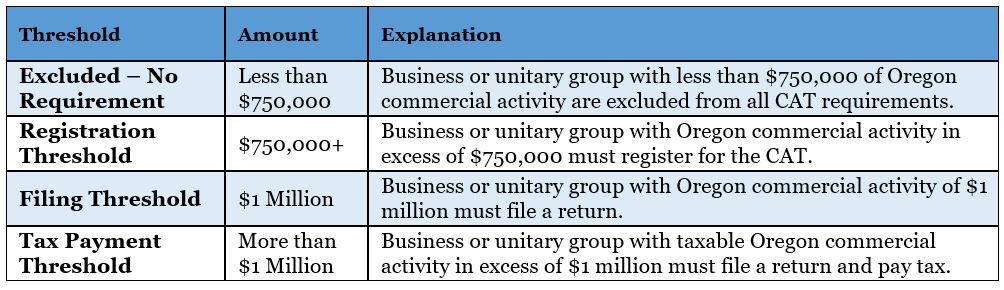

The oregon corporate activity tax (oregon cat) became effective in late september 2019 and is applicable for years beginning on or after january 1,. 4 rows oregon's cat is measured on a business's commercial activity —the total amount a business. 12 the full list of exclusions is found in h.b.

The oregon corporate activity tax (cat) is effective on january 1, 2020. How much is the cat? Thus, quarterly estimated payments are due on april 30, july 31, october 31, and january 31 each year, with tax returns due on april 15 of the following year.

• the taxpayer had no ability to determine whether they will have cat liability for the 2020 tax year, after taking into consideration exclusions and subtractions provided in ors chapter 317a. “groceries” are defined for this purpose as “food” by. Note that rental activities are not excluded from the cat tax.

The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax; •the wholesaler certifies the items that will be sold out of state. In contrast to its title, it applies to all forms of business, including individuals, partnerships, limited liability companies (llcs), and trusts.