Oregon Cat Tax Calculation

Oregon Cat Tax Calculation - Cat Meme Stock Pictures and Photos

Top 10 elk hunting outfitters top 50 hardware store chains.

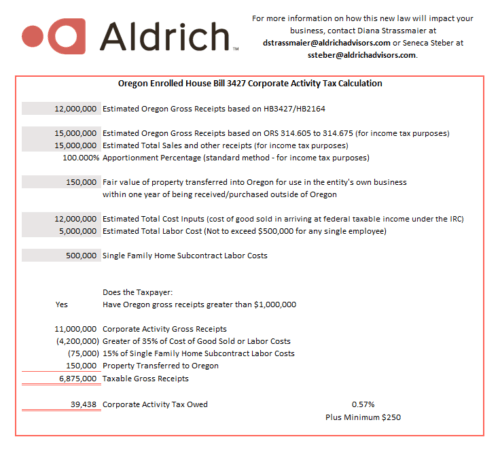

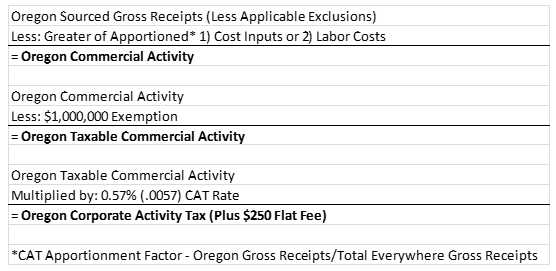

Oregon cat tax calculation. How oregon’s new corporate activity tax affects the timber industry. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million. Apply a 6.6% corporate income tax rate on corporate income up to $1 million.

Oregon cat imposed on taxable commercial activity. The cat is estimated to increase the oregon tax liability of businesses by more than $1 billion per year and is codified in the new section 317a of oregon revised statutes. 1, 2020, regardless of a taxpayer's year end for accounting and federal income tax purposes.

Oregon association of tax consultants 3075 s.e. The deduction is limited to 95% of. Apply a 7.6% corporate income tax rate on corporate income above $1 million.

What is a “substantial nexus”? This discussion explores a few considerations for taxpayers potentially subject to cat. The simple calculation for the cat is:

You may be required to make quarterly estimated payments as well. Rental income is subject to the new cat tax beginning january 1, 2020. It is 0.57% of a firm’s oregon taxable commercial activity in excess of $1,000,000 plus $250.

The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax; 1 imposed in addition to oregon’s existing taxes, the cat is intended to The tax is imposed on oregon commercial activity in excess of $1 million at a 0.57% tax rate, plus a $250 minimum fee.