Cat Tax Oregon Instructions

Cat Tax Oregon Instructions - Cat Meme Stock Pictures and Photos

Oregon senate bill 164, which was recently signed into law, modifies certain provisions of the corporate activity tax (cat).

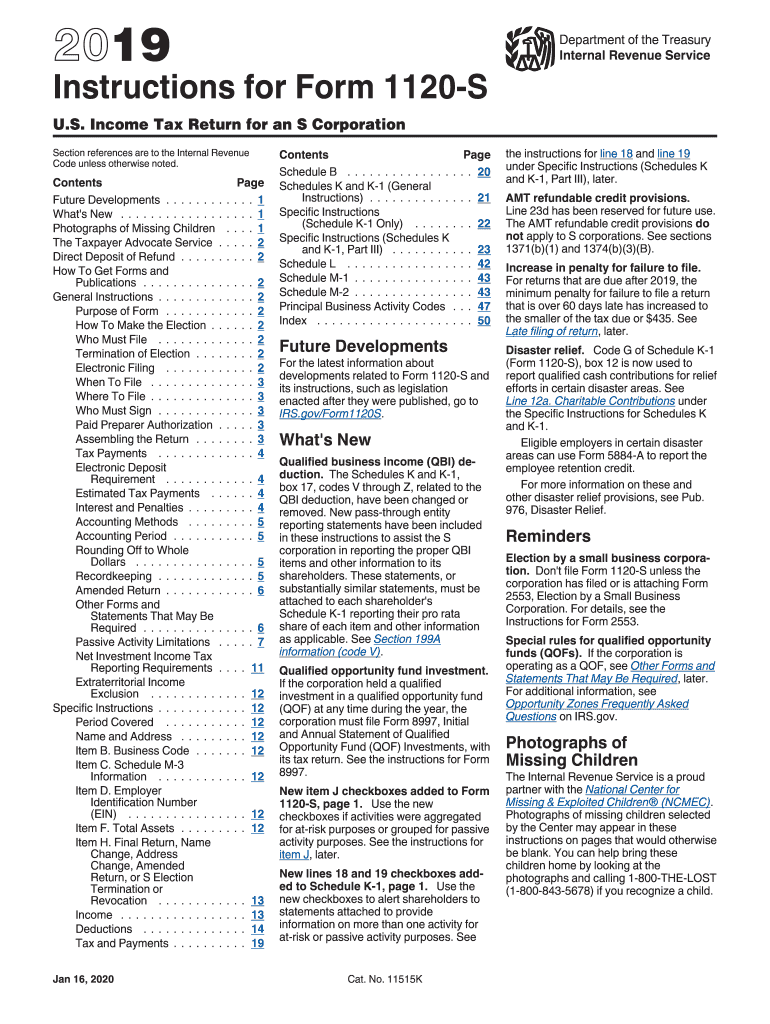

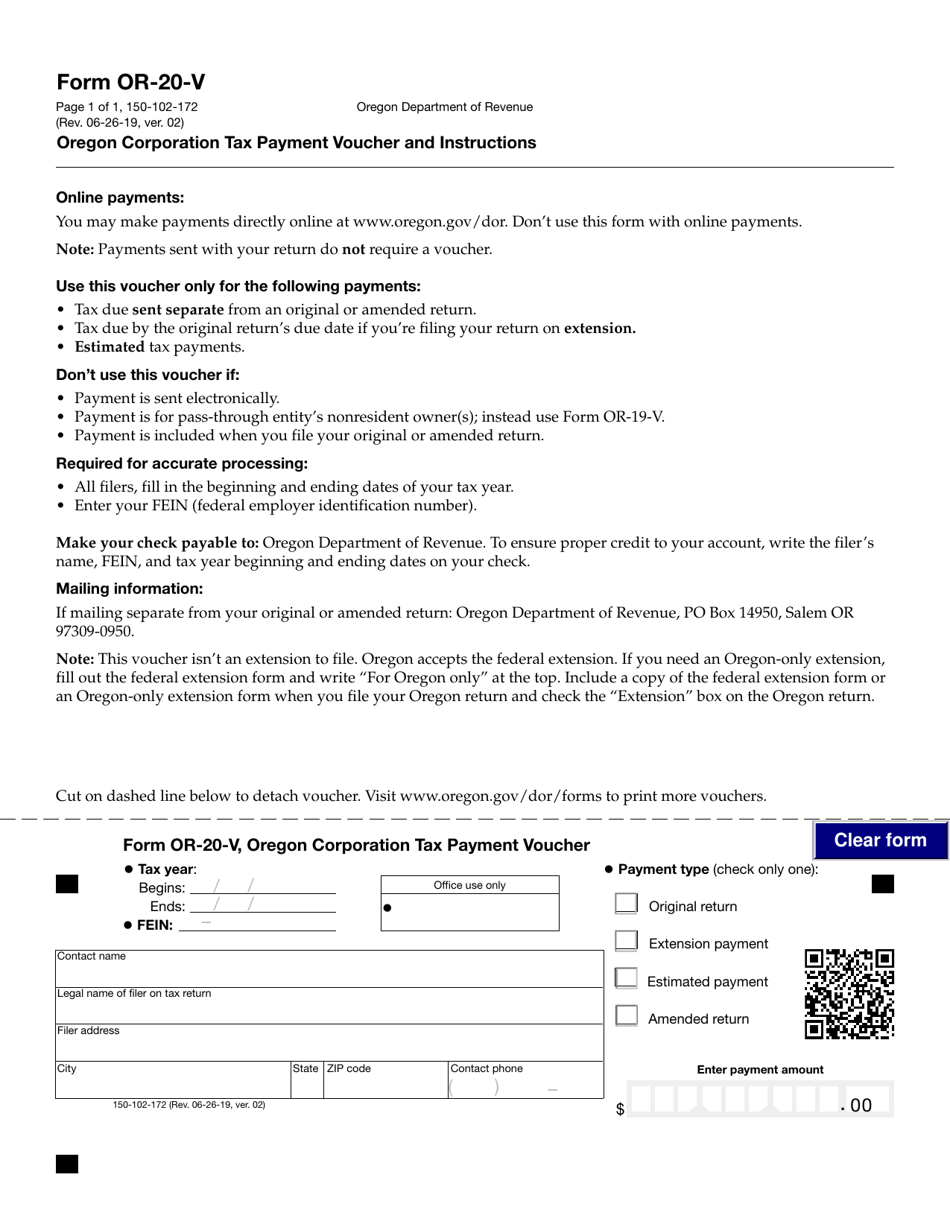

Cat tax oregon instructions. Additionally, sb 164 changes the return filing due date to the 15th day of the fourth month following the end of the tax year. If a business does not have oregon taxable commercial activity in excess of $1,000,000, then it will not owe any tax, including the $250 minimum tax. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million.

The new corporate activity tax (cat) will be imposed on “taxable commercial activity” in excess of $1 million at a rate of 0.57%, plus a flat tax of $250. However, taxpayers (including unitary groups) exceeding $750,000 of oregon “commercial activity” are required to register for the cat within 30 days of meeting. This form is for income earned in tax year 2021, with tax returns due in april 2022.we will update this page with a new version of the form for 2023 as soon as it is made available by the ohio government.

Oregon has enacted a new gross receipts tax on any commercial entity with gross receipts in excess of $1 million from oregon specific sources and is expected to raise $1 billion per year for oregon schools. Claim to refund due a deceased person. If you don’t pay all the cat due by the 15th day of the fourth month following the.

Cat estimated tax payments are due april 30th, july 31st, october 31st, and january 31st, for the preceding quarter. Estimated payments, which can be calculated using the estimated payment worksheet on page 5 of the cat return instructions , are due for the previous quarter on or before the last day of the 4 th, 7 th, and 10 th months of the tax year, and on the last day of the first month immediately following the end of the tax. A taxpayer may be subject to both oregon income tax and cat.

Those with oregon commercial activity in excess of $1 million are required to file a cat return. You must be registered for oregon corporate activity tax (cat) prior to submitting this form. Download or print the 2021 ohio form cat 1 instructions (ohio commercial activity tax (cat) instructions for registration) for free from the ohio department of taxation.

This discussion explores a few considerations for taxpayers potentially subject to cat. Revenue online 2 log in to your revenue online account using your username (email) and password. The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax;