Cat Tax Oregon Form

Cat Tax Oregon Form - Cat Meme Stock Pictures and Photos

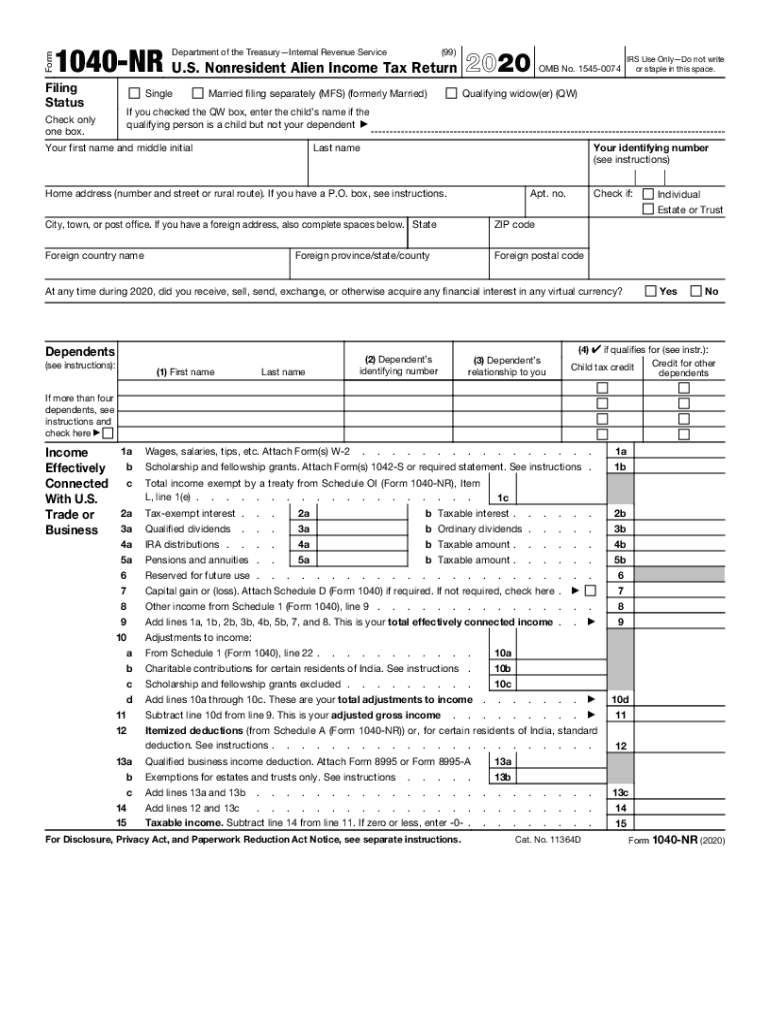

The basics of the tax.

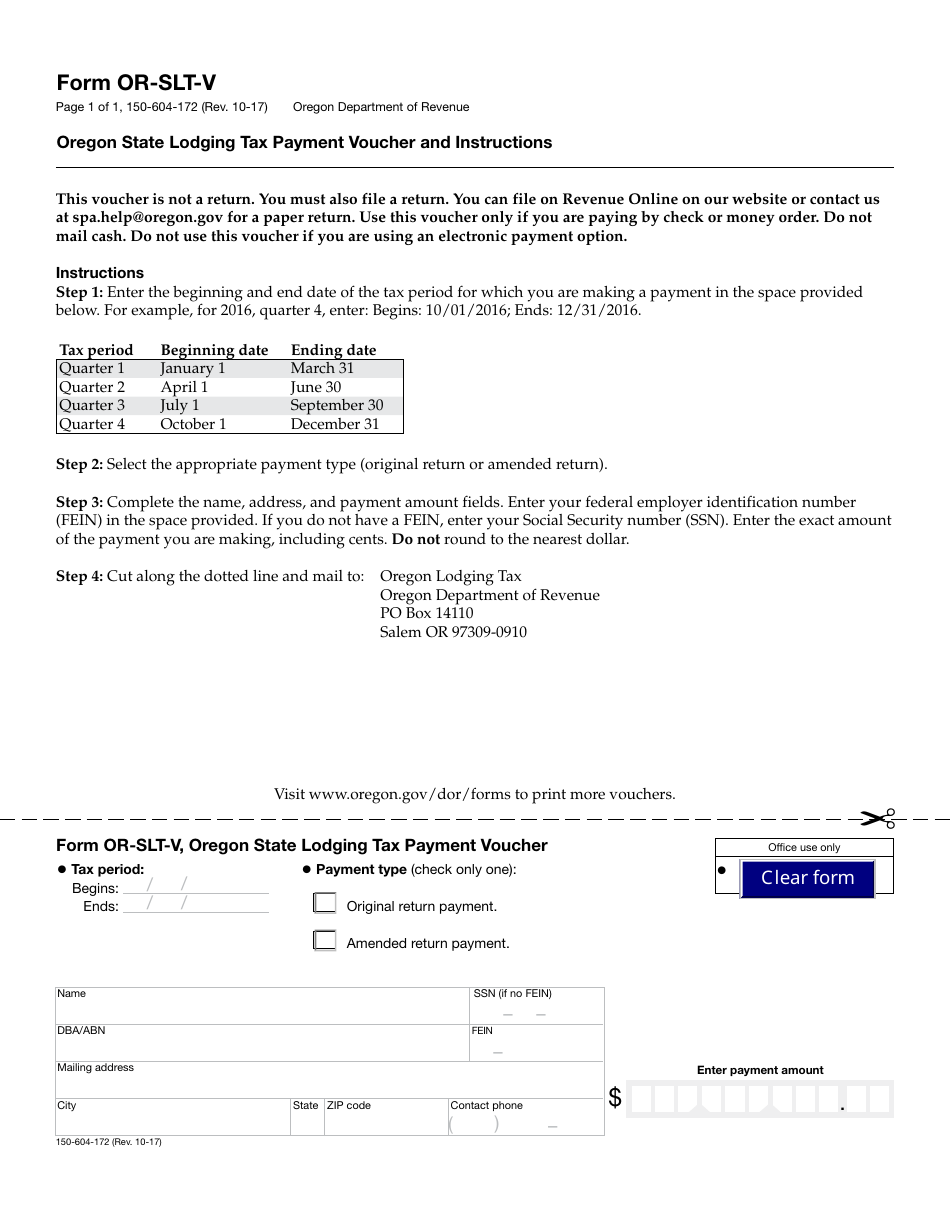

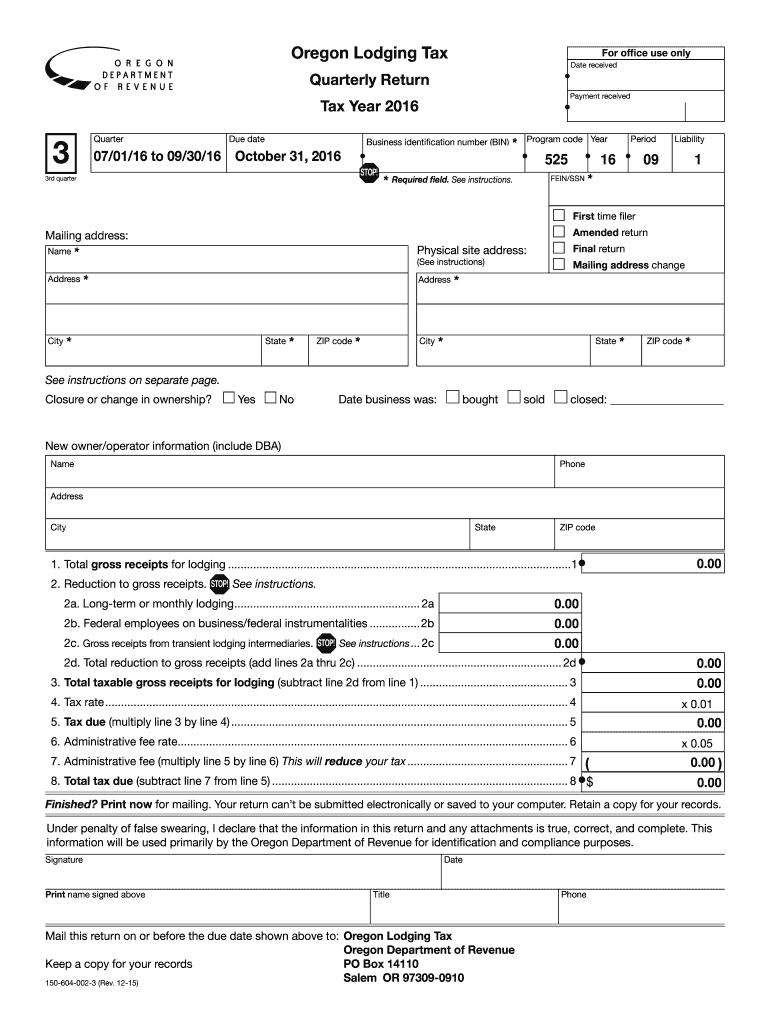

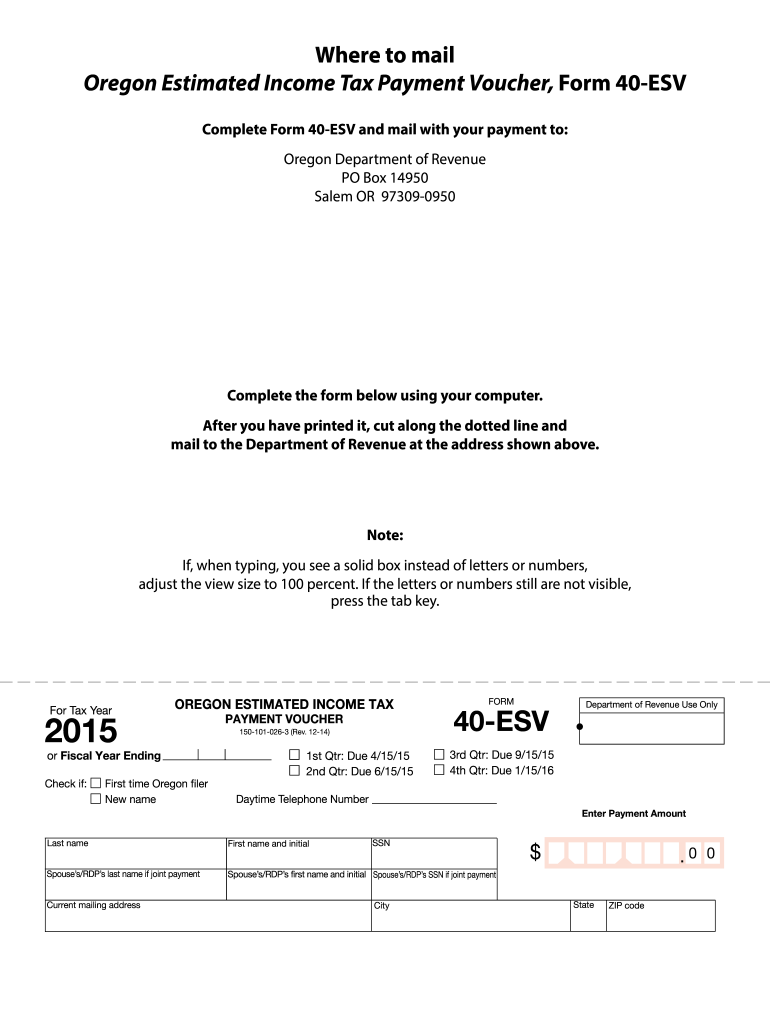

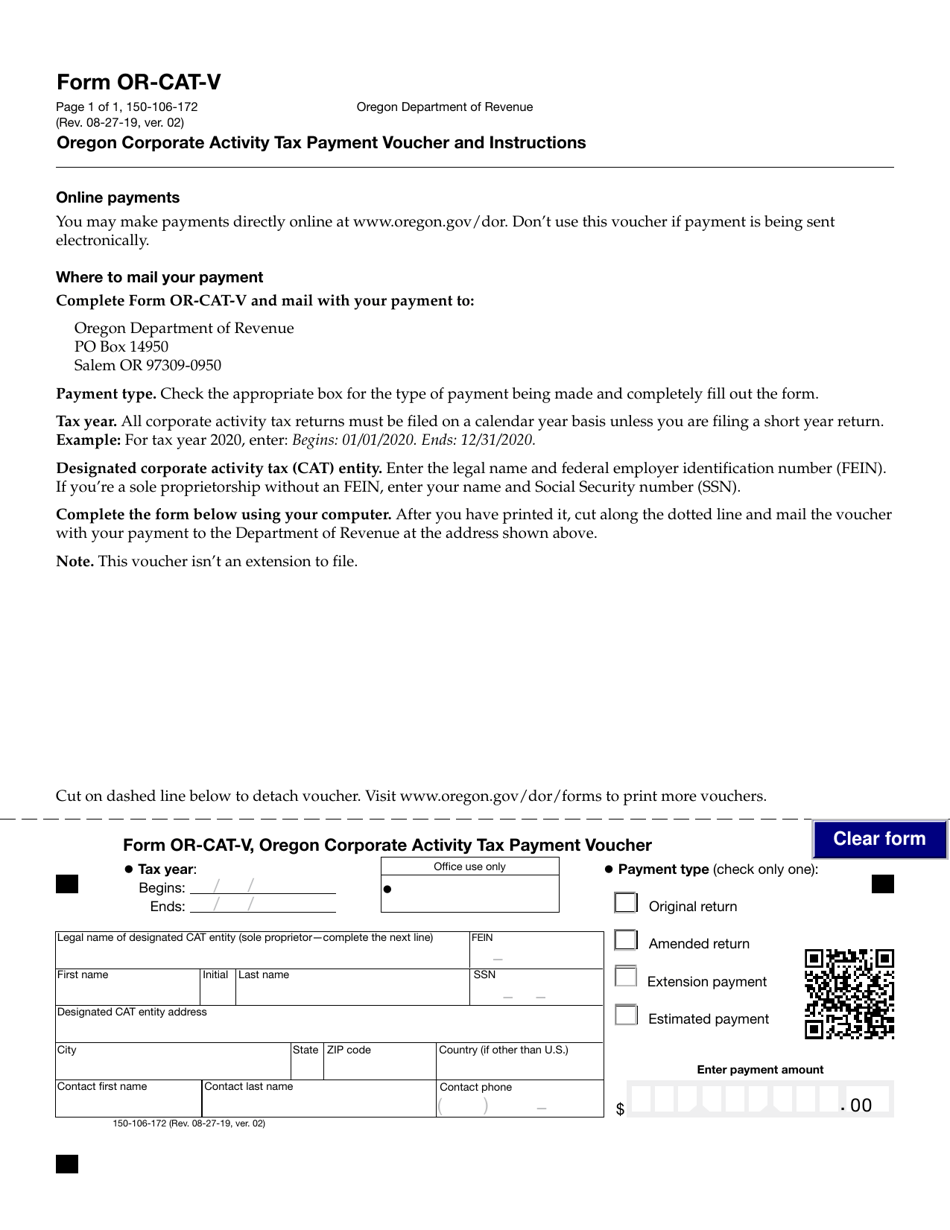

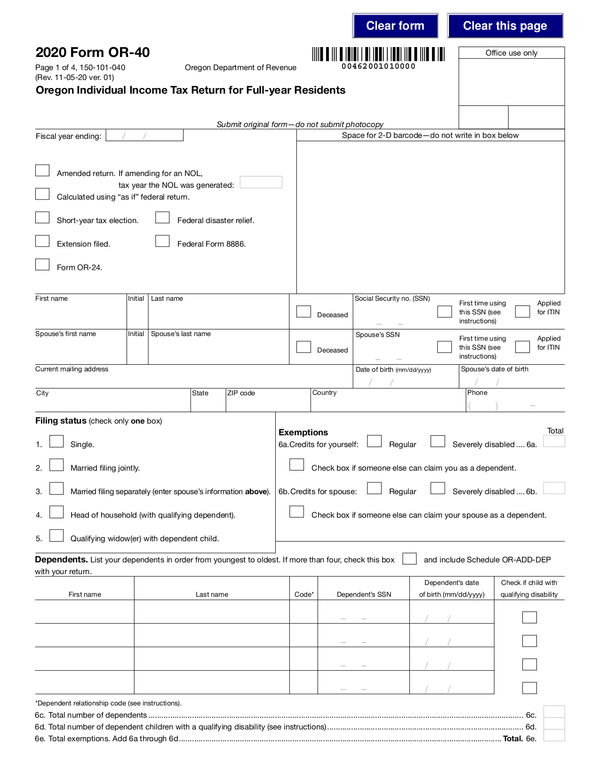

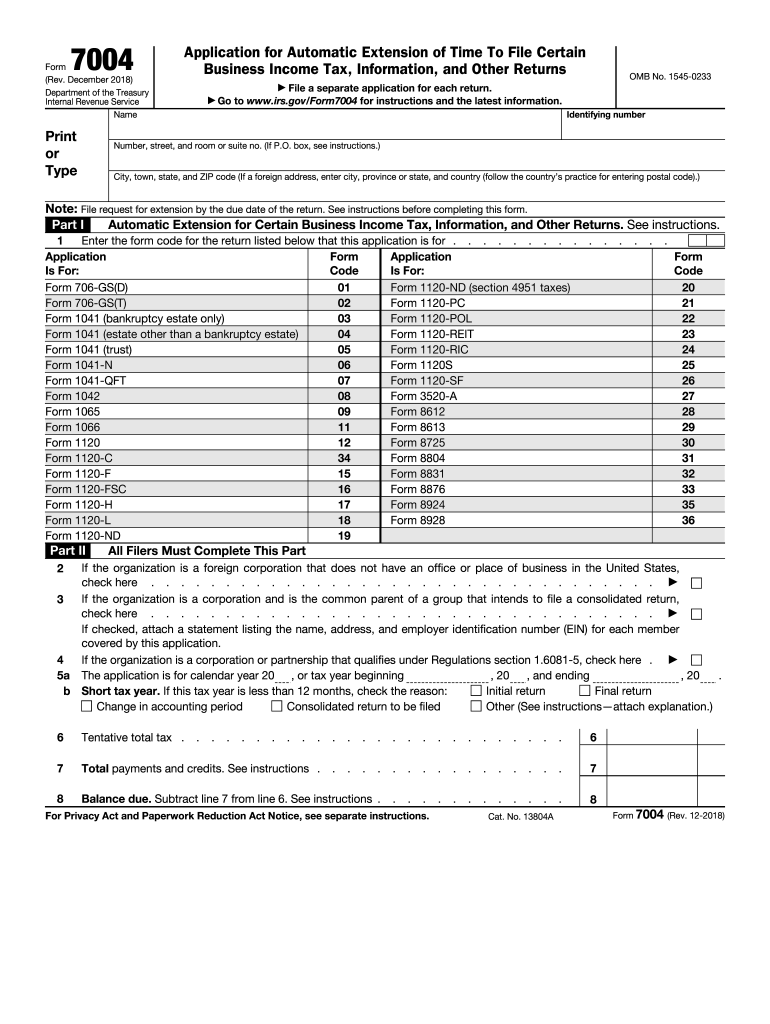

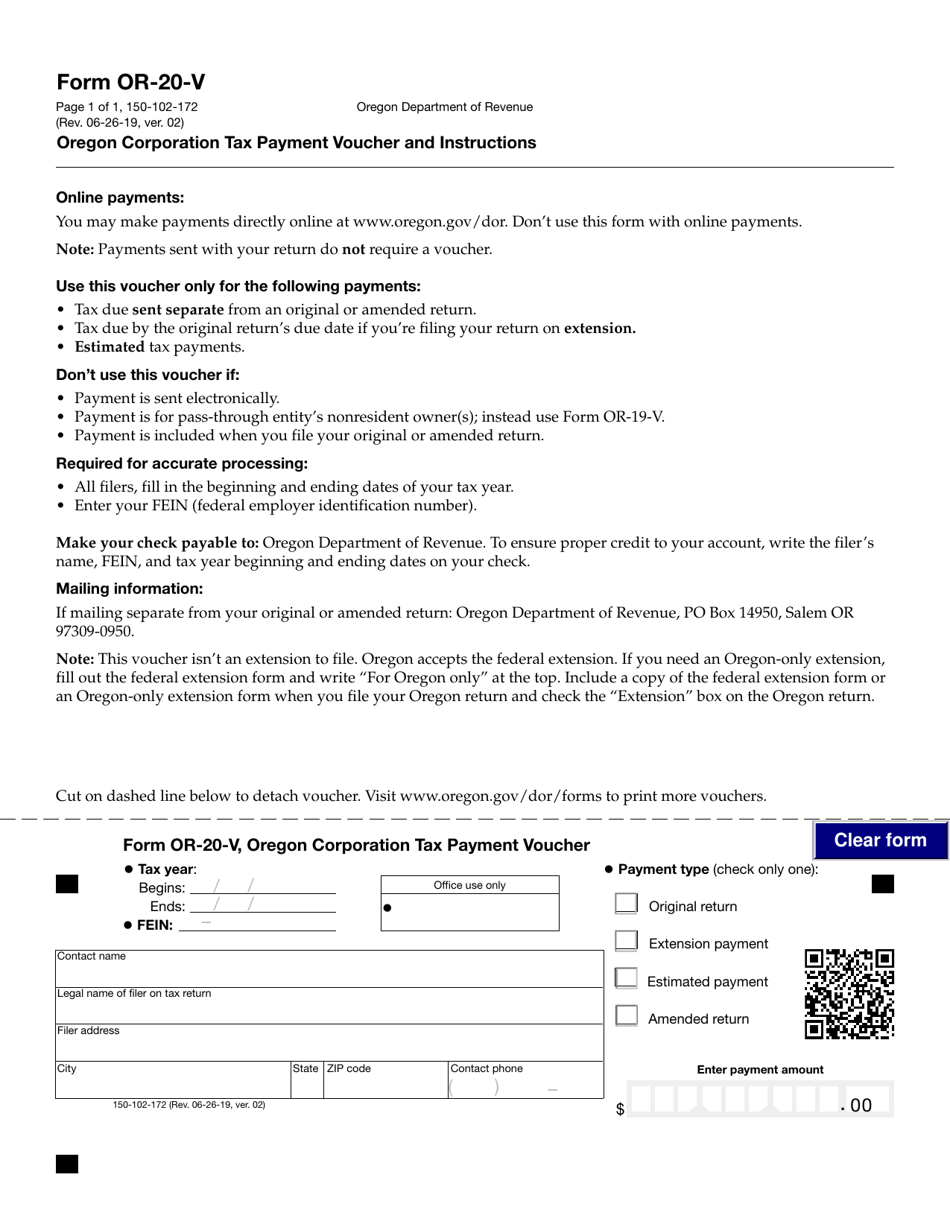

Cat tax oregon form. • use blue or black ink. Legal name of designated corporate activity tax (cat) entity (sole proprietor—complete the next line) contact first name last name social security number (ssn) current address. Enter only one tax form number per request.

Due to the hurried nature of developing a brand new tax regime, the cat was destined for future revisions. 01) • use uppercase letters. About the corporate activity tax the oregon legislature created the corporate activity tax during the 2019 session to provide new funding for early.

A taxpayer may be subject to both oregon income tax and cat. If you don’t pay all the cat due by the 15th day of the fourth month following the. The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million.

The deduction is limited to 95% of. The cat tax equals $250 plus the product of the taxpayer’s taxable commercial activity in excess of $1 million for the calendar year multiplied by.57%. The cat is imposed on taxable oregon commercial activity in excess of $1 million at a rate of 0.57 percent plus $250.

The cat is effective for tax years beginning on or after jan. A taxpayer may be subject to both oregon income tax and cat. Payments made with extension or other prepayments for this tax year.

To get tax forms, check the status of your refund, or make tax payments, visit oregon.gov/dor or email questions.dor@ oregon.gov. • don’t submit photocopies or use staples. The oregon cat allows for a routine deduction of some costs of doing business, resulting in a downward adjustment of the tax base.