Cat Tax Oregon Car

Cat Tax Oregon Car - Cat Meme Stock Pictures and Photos

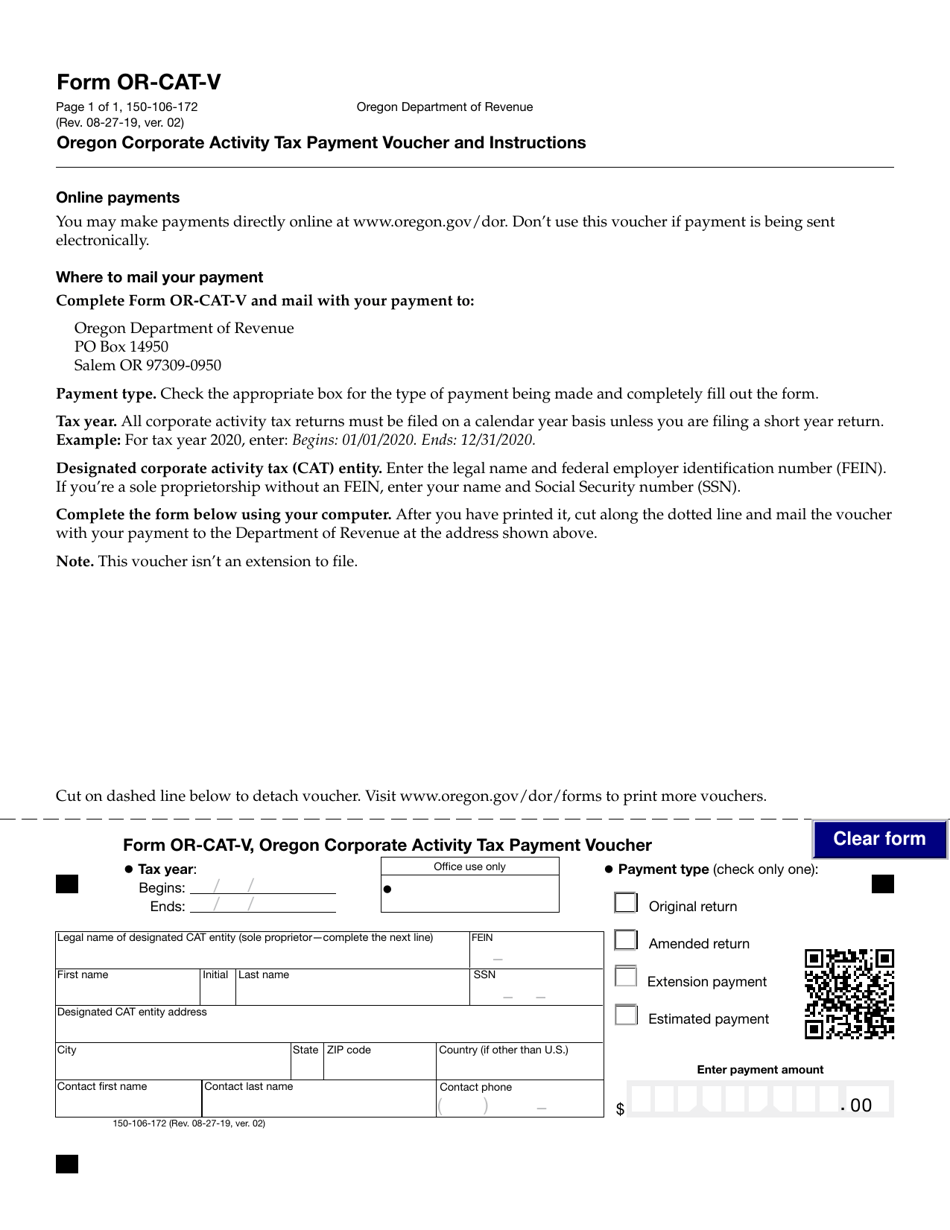

23/01/2020 · where is the form for oregon corporate activity (cat) tax?

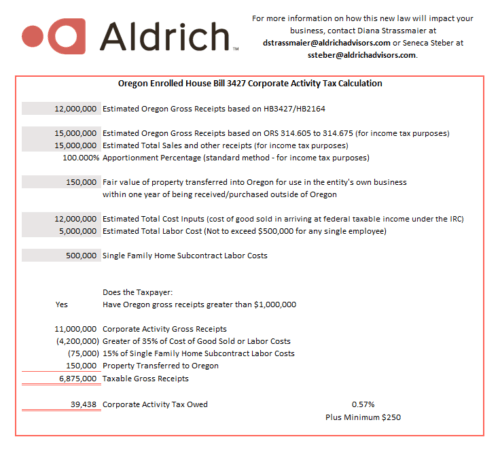

Cat tax oregon car. Grocery & tv mart has $10 million of oregon commercial activity and $70 million of everywhere. The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax; The oregon department of revenue (the “department”) recently issued four new temporary rules relative to the oregon corporate activity tax (the “cat”).

9 the tax is imposed on. However, taxpayers (including unitary groups) exceeding $750,000 of oregon “commercial activity” are required to register for the cat within 30 days of meeting the threshold. You can only avoid this tax if you purchase the car in a no sales tax state and then register the vehicle in that state as well.

As advertised, the oregon department of revenue (“dor”) was able to issue additional guidance in late december. How much is the cat? The cat is applied to taxable oregon commercial activity in excess of $1 million.

The tax is computed as $250 plus 0.57 percent of taxable oregon commercial activity of more than $1 million. (all vehicles have a gross vehicle weight of less than 26,000 pounds) registration: The oregon cat is a separate tax and may be imposed regardless of any oregon income or excise tax;

8 taxpayers whose taxable commercial activity does not exceed $1 million are exempt from the oregon cat. Taxable oregon commercial activity taxable oregon commercial activity. §320.405 privilege tax imposed on oregon vehicle dealers is subject to the oregon cat when collected from a vehicle purchaser.

The tax is computed as $250 plus 0.57 percent of oregon commercial activity in excess of. Oregon has enacted a new gross receipts tax on any commercial entity with gross receipts in excess of $1 million from oregon specific sources and is expected to raise $1 billion per year for oregon schools. The cat is imposed on taxable oregon commercial activity in excess of $1 million at a rate of 0.57 percent plus $250.

![Oregon CAT Tax Get Organized!, LLC [GO!]](https://gogetorganized.com/wp-content/uploads/2021/03/Depositphotos_9415227_s-2019.jpg)