Cat Tax Oregon Calculator

Cat Tax Oregon Calculator - Cat Meme Stock Pictures and Photos

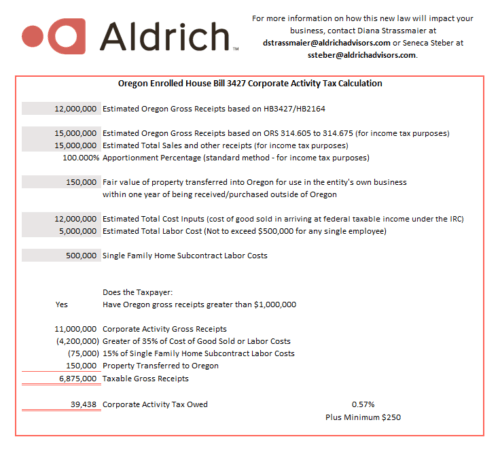

This discussion explores a few considerations for taxpayers potentially subject to cat.

Cat tax oregon calculator. This percentage will be applied to the 35% of cost or labor inputs to calculate the allowable deduction in calculating oregon taxable commercial activity. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Oregon association of tax consultants 3075 s.e.

Eep it with your tax records. Don’t include this form with your oregon return. The cat is applied to oregon taxable commercial activity in excess of $1 million.

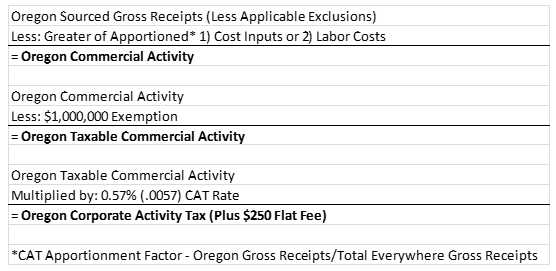

As previously reported, the new oregon corporate activity tax (the “cat”) went into effect on january 1, 2020.the new law is quite complex and arguably not very well thought out by lawmakers. The simple calculation for the cat is: To calculate cat, you must add to your current benefit any previous gifts or inheritances received under the same group threshold since 5 december 1991.

The new corporate activity tax (cat) will be imposed on “taxable commercial activity” in excess of $1 million at a rate of 0.57%, plus a flat tax of $250. The cat is applied to taxable oregon commercial activity in excess of $1 million. Tax collections are managed primarily by the 36 counties in oregon, which assess property and calculate taxes owed.

You may be required to make quarterly estimated payments as well. Overview of oregon taxes oregon levies a progressive state income tax system with one of the highest top rates in the u.s., at 9.90%. However, taxpayers (including unitary groups) exceeding $750,000 of oregon “commercial activity” are required to register for the cat within 30 days of meeting the threshold.

1, 2020, regardless of a taxpayer's year end for accounting and federal income tax purposes. It is 0.57% of a firm’s oregon taxable commercial activity in excess of $1,000,000 plus $250. For the 2020 tax year, which you file in early 2021, the top rate is 4.797%.