Cat Tax Due Dates Oregon

Cat Tax Due Dates Oregon - Cat Meme Stock Pictures and Photos

April 30 — first quarter 2021 cat estimated payments due.

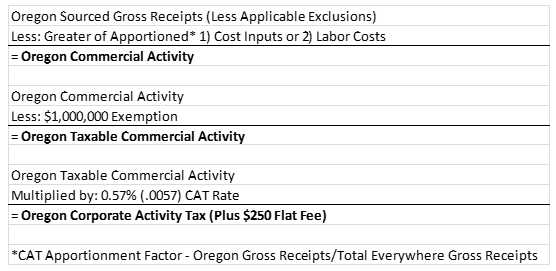

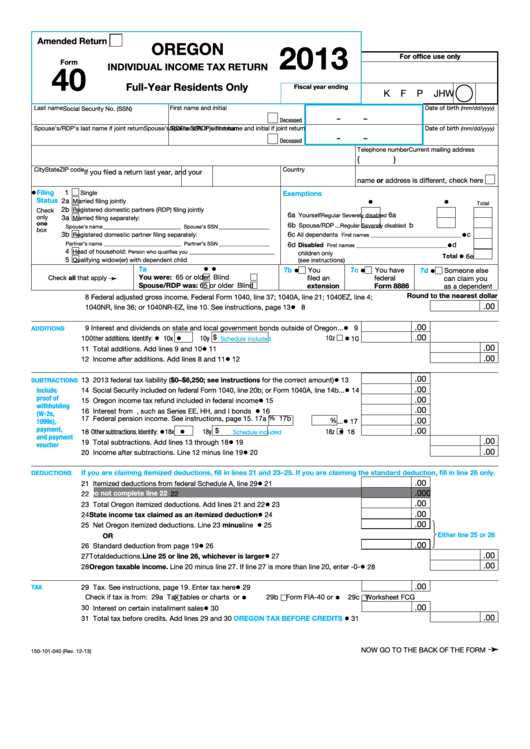

Cat tax due dates oregon. Estimated payments are required if the estimated annual tax exceeds $5,000. October 27, 2020 october 27, 2020 / leave a comment. The oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to july 15, 2020.

November 1—third quarter 2021 cat estimated payments due. Currently, all taxpayers file their cat returns using the calendar year as the cat year. On october 26, 2020, the oregon department of revenue (“dor”) released two anticipated oregon corporate activity tax (“cat”) draft rules:

11 under the temporary rule cited above, a taxpayer may request an extension of six months to file oregon cat return; Going forward, fiscal filers must submit their cat returns no. What happens when the due date for the estimated tax falls on a weekend?

The oregon cat allows for a routine deduction of some costs of doing business, resulting in a downward adjustment of the tax base. Those short year returns are due by april 15, 2022. April 15 — last day to file cat return without an extension or apply for an extension for filing a cat return.

These payments are still due on april 15. 2020 and the first estimated tax payment is due april 30, 2020 (more on that later). Oregon senate bill 164, which was recently signed into law, modifies certain provisions of the corporate activity tax (cat).

The cat is a calendar year tax and is effective beginning january 1, 2020, with the first corporate activity tax return due april 15, 2021. Details, cost, impact behind oregon cat tax. Taxpayers using a fiscal calendar for income tax purposes (and whose calendar year began during 2021) are required to file a 2021 short year return no later than april 15th, 2022.